So, what does 43 days mean for current and retired baseball pros? It is the total number of service days required to qualify for the MLB Pension Plan. The Major League Baseball Player’s Association battled hard to get it in place, so in this blog, we’ll be explaining why it’s important for players to take full advantage.

When the time comes for a player to retire from professional baseball, having access to a share of the MLB Pension Plan can go a long way, especially for those whose careers may have been cut short due to injury. So, what exactly is the MLB Pension Plan? How does it benefit players? And how can a partner like BIP Wealth help baseball players secure their financial future?

The MLB Pension Plan is a type of employer-sponsored retirement plan, also known as a defined benefit plan. These types of plans provide retired professionals with a monthly payment based on a certain formula.

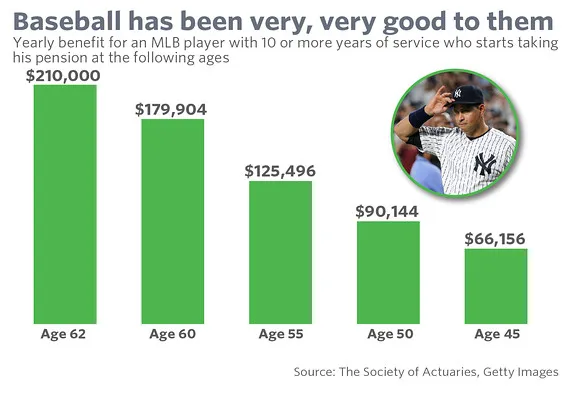

The MLB Pension Plan can be “turned on” as early as age 45, but by waiting until age 62, players would maximize their potential payouts. After hitting 43 days of service, which is defined as days spent on an active MLB roster or injured list, a player qualifies for 2.5% of the max payout. Every additional 43 days will accrue another 2.5% and so on until a player hits 10 years of service, which would qualify them for the max payout.

Currently, the average monthly MLB Pension Plan payout sits at around $7,500 per month, but those who wait until age 62 could top out at around $265,000 per year.

For young and active ballplayers, we recommend focusing on having the most successful and sustainable career possible, as this will directly impact your MLB Pension Plan qualifications. A partner like BIP Wealth will help you navigate the intricacies of your pension plan to better set you up for a successful financial future.

Once you enter your retirement years, our team will work to maximize your accumulated benefits and consider other savings methods, such as IRAs, Roth IRAs, and 401k plans.

The upside of having an MLB pension plan goes further than just the obvious benefit of players receiving a guaranteed monthly payment. The money players receive lasts for life, giving them a consistent income to lean into as they enjoy retirement or search for new career opportunities. There is a cost-of-living adjustment with MLB Pension Plans, so payments will increase over time based on inflation.

A retirement plan for MLB players can also give them a sense of financial security for their later years off the playing field. Savings, unlike funds from a pension plan, can easily be spent before retirement, which has led to an unfortunate 78% of former professional athletes going broke within three years of retirement.

On top of all of this, there are also spousal benefits that can be earned through the MLB Pension Plan. This can significantly help beneficiaries achieve the peace of mind that they and their families will be taken care of for life.

At BIP Wealth, we want to make sure every professional baseball player we take on as a client maximizes their financial potential. To do this, we not only help them through their MLB Pension Plan process but also create unique, life-long financial plans that fit the needs of themselves and their families.

As former professional baseball players, our financial advisors have a unique insight into the MLB Pension Plan and how to best plan for what comes after their playing days. This allows us to provide a perspective that most other wealth managers can’t. We’ve been in a player’s shoes, and we can relate to a player’s financial needs and worries.

To learn more about our services and how you can maximize your career earnings, contact us to speak with one of our advisors. You can also schedule a time to talk with us on the phone or at one of our locations in Buckhead, Alpharetta, and Columbus GA, as well as Nashville, TN.

How much do MLB players get for pension?

Major League Baseball players receive 2.5% of their max monthly pension plan payout, currently up to $265,000 per year, for every 43 days of active service.

How much is a 10-year MLB pension?

Once a player officially hits 10 years of service, they are eligible for up to $265,000 per year if they wait until age 62 to activate their pension plan.

How much is MLB’s pension per year?

The number varies depending on a player’s number of active service days. At the current max payout, a player would receive $3.18 million per year.

What is your experience and expertise in working with professional athletes, particularly professional baseball players?

At BIP Wealth, our Baseball Division advisors have all been professional baseball players, allowing us to provide clients with a unique perspective that is hard to find anywhere else in the industry.

How can you help professional baseball players optimize their taxes and make the most of their earnings during their playing careers and beyond?

Beyond maximizing their MLB Pension Plans, we take the time to understand a player’s unique financial situation and needs, creating tailored financial plans that can include 401ks, IRAs, and more.

This communication contains general investing information that is not suitable for everyone and is subject to change without notice. Past performance is no guarantee of future results and there is no guarantee that any views and opinions expressed will come to pass. The information contained herein should not be construed as personalized investment advice, tax advice, or financial planning advice, and should not be considered a solicitation to buy or sell any security. Investing in the stock market and the bond market involves gains and losses and may not be suitable for all investors. Indices are not available for direct investment.

For current and prospective investors in today’s diverse marketplace, there are a number of ways to manage your strategy and holdings. Two of these are investment management and asset management. If you’re unfamiliar with either of these, you’ve come to the right place. In this blog, we’re going to break down the two, including the scope and what an asset manager vs. an investment manager’s role will look like.

Because both strategies come with inherently unique paths to cultivating and growing wealth, we’ll also be examining the nuances between each that may align better with certain financial goals and aspirations. So, whether you’re an individual looking to invest for the first time, an individual looking to better manage your current financial investments, or an institution with vast resources, this blog will help shed light on which strategy may be the better fit for you. To start, let’s take a look at investment management vs. asset management.

To kickstart the investment management vs. asset management analysis, let’s first focus on the former. By definition, investment management is the handling of financial assets and other investments. It is important to keep in mind that this management strategy does not simply focus on buying and selling stocks, for example. It could also include strategies for budgeting, taxes, and more as well.

At its core, investment management is the professional art—and science—of managing a portfolio of securities, such as stocks and bonds, to ultimately achieve an investor’s specific goals. The primary goal is wealth accumulation through strategic buying, selling, and holding of these securities based on comprehensive market research, trend analysis, and a deep understanding of global economic factors.

Some of the pros you’ll find with investment management are the ability to create tailored strategies to your individual needs and goals and active management from your investment manager. At BIP Wealth, we focus on holistic wealth management and follow guiding principles such as expert insights and human connection, transparency and accessibility, and intelligent forecasting to help our clients navigate the road between risk and reward. To learn more, be sure to check out our holistic wealth management services page.

Asset management, though sometimes used interchangeably with investment management, encompasses a much wider range of wealth management. Think of it this way: Investment management can be considered a part of an asset management strategy, but asset management compared to investment management extends to a myriad of other tangible and intangible assets, including real estate, commodities, intellectual property, and sometimes even assets like artwork or vintage cars.

At its heart, asset management is also about understanding an investor’s unique needs and goals and focusing capitalizing on them in the long term. Because it encompasses so many more financial holdings, asset management vs. investment management may focus more on sustained long-term growth rather than short-term gains in the stock market, for example.

You’ll find that many of the pros to asset management are similar to investment management. Both asset management and investment management tend to give investors a much more holistic wealth management experience. Additionally, asset management may give investors access to alternative investments such as private equity and hedge funds. At BIP Wealth, our team of experienced financial advisors works to give our clients access to financial wealth opportunities that have historically been reserved for the ultra-wealthy.

Both asset managers and investment managers critical focus is on creating wealth for their clients. Now, there are some differences in the roles each takes on. Investment managers tend to focus specifically on the domain of stocks, bonds, and mutual funds. Their day-to-day may be more centered around market research, trend analysis, and portfolio balancing.

Asset managers, on the other hand, operate on a much broader canvas. They may put more focus into portfolio optimizations, strategizing with clients on the acquisition of, maintenance, and even the sale of a wide range of assets—from stocks to homes to luxury goods.

To put it simply, while both are stewards of wealth, their focal points differ. The investment manager is a craftsman, meticulously sculpting portfolios, while the asset manager is the mastermind, orchestrating an all-encompassing wealth strategy.

Because the journey of wealth management is a personal one, deciding which strategy may be right for you will take time—and be dependent on a number of factors. For individual investors who are looking to grow their wealth primarily through stocks and bonds, investment management may be the right way to go. For those who already own a high number of valuable assets, asset management may be the better choice. For larger organizations and businesses, the expansive and strategic purview of asset management also tends to align well, ensuring that assets are managed and grown cohesively over extended periods.

It is important to first consider your risk tolerance, as this can play a significant role in which strategy is right for you. If you prefer a more hands-on, active strategy with frequent adjustments, investment management’s active approach might resonate. Conversely, if you’re looking at long-term stability and diversified risk, asset management, with its wider asset base, might be more fitting.

If you have any questions or want to speak to one of our financial advisors, don’t hesitate to contact us. You can also check out our Resources to learn more about topics in the financial space, including portfolio vs. wealth management and why the Roth IRA is the “holy grail” of tax-smart investing.

What is the difference between asset management and investment management?

At its core, the difference between investment management vs. asset management is the scope of what is managed. Investment management tends to focus solely on stock and bonds while asset management can encompass a wider range of assets, such as homes and luxury goods.

Is an investment manager the same as an asset manager?

No. While the two share a similar role, asset managers tend to operate on a much broader canvas, including the management of a much wider range of financial assets, compared to investment managers.

Is asset management better than investment management?

It depends on what your financial goals and needs are. For individuals and organizations with many financial assets, asset management may be the better option. However, for individuals looking to start a stock portfolio, investment management may be the better choice.

This communication contains general investing information that is not suitable for everyone and is subject to change without notice. Past performance is no guarantee of future results and there is no guarantee that any views and opinions expressed will come to pass. The information contained herein should not be construed as personalized investment advice, tax advice, or financial planning advice, and should not be considered a solicitation to buy or sell any security. Investing in the stock market and the bond market involves gains and losses and may not be suitable for all investors. Indices are not available for direct investment.

When planning for your financial future, there are a number of routes you and your loved ones can take. Two of those routes are portfolio and wealth management. At first glance, they may seem very similar, but the two are significantly different from each other.

Portfolio management, also referred to as asset management, serves as a focused investment strategy, where investors seek to see the best possible returns while balancing risk. Wealth management, on the other hand, is a much more holistic approach, often involving everything from investments to retirement planning.

So, what differentiates portfolio vs. wealth management? And which option is right for you? In this blog, we’ll break it all down.

Let’s start the portfolio vs. wealth management discussion by first breaking down the main characteristics of each option. Both portfolio and wealth management present clients with a unique financial plan. In portfolio management, it’s important to consider risk versus reward. This is a focused, targeted approach in which investors invest in assets to try and secure the highest possible returns while managing their overall portfolio risk.

There are four different types of portfolio management. Active, passive, discretionary, and non-discretionary. In active portfolio management, the goal is to achieve higher returns than the market benchmark. In passive portfolio management, the goal is to match an index or benchmark’s performance. Discretionary and non-discretionary portfolio management deal with a portfolio manager’s ability to make decisions about an investor’s holding with or without their insights. Ultimately, the goal is the same: grow an investor’s portfolio through assets such as stocks.

A portfolio manager will typically be tasked with making investment decisions, managing assets, and ensuring that investments align with the established objectives and strategy. They analyze market trends and investment opportunities to make informed decisions that will contribute to the financial growth of the client.

In a discretionary arrangement, the manager can make decisions for their client without the need for ongoing authorization. In a non-discretionary arrangement, the client will reserve the right to accept or decline any potential strategy that their portfolio manager suggests.

When comparing wealth management vs. portfolio management, wealth management is much more comprehensive. This financial strategy encompasses a much wider range of services to better tailor the right approach to a client’s specific needs or long-term goals. It goes beyond investment strategies to grow and safeguard a client’s wealth over time. For example, a portfolio manager may reinvest funds from one stock to another while a wealth manager may complete the same step while also setting aside funds for a client’s retirement fund.

There are five core elements of a well-run wealth management strategy. The first is financial planning to reach both short and long-term goals. Asset allocation is the second, in which clients are given tailored strategies based on their goals and willingness to take risks. The third is asset management. Finally, four and five are estate and tax planning. Together, these five core elements make up a true holistic wealth plan for clients.

To put it simply, a wealth manager wears a lot of hats. They assess a client’s entire financial situation and devise a comprehensive strategy to meet the client’s goals. Their role involves continuous monitoring and adjustment of the financial plan to ensure it remains aligned with the client’s objectives, changing life circumstances, and market conditions. When the unexpected happens, a wealth manager must be ready to spring into action to help their clients navigate any newfound financial circumstances.

So, now that we’ve established what makes each strategy different, you might be wondering which option could be best for you. When analyzing portfolio vs. wealth management, it’s important to first ask yourself what your goal is. Are you looking for a short-term or a long-term financial plan? If you said the former, portfolio management may be the way to go. If you answered the latter, wealth management may be the better fit for you and your family.

It’s also important to consider how much risk you’re willing to take on as part of your financial and investment plans. Consider your goals and how you want to achieve them. We should note that neither portfolio nor wealth management strategies can ever guarantee returns. Always consult with a financial expert before rushing into any decision.

If portfolio and wealth management are on your radar, our team is ready to help you plan for the future. At BIP Wealth, we’re engineered to perform for you. Think of us as having your own personal CFO. We work closely with each client to create personalized plans based on empirical research with savvy integrations of alternative investments to help clients gain access to investment opportunities historically saved for just the upper class. Through family-style wealth management, including comprehensive estate, tax, and investment planning, our experienced team aims to foster a sense of belonging for each client. To learn more about our services, visit our financial planning page. You can also contact us to get in touch with one of our wealth managers.

What are the four types of portfolio management?

The four types of portfolio management are active, passive, discretionary, and non-discretionary.

What is the difference between portfolio and wealth management?

Portfolio vs. wealth management comes down to the level of services. Portfolio management focuses on assets and investments while wealth management focuses on long-term holistic wealth plans.

What is the difference between a financial advisor and a portfolio manager?

A financial advisor generally provides a broad range of financial planning and investment services to clients, while a portfolio manager tends to focus specifically on investments.

This communication contains general investing information that is not suitable for everyone and is subject to change without notice. Past performance is no guarantee of future results and there is no guarantee that any views and opinions expressed will come to pass. The information contained herein should not be construed as personalized investment advice, tax advice, or financial planning advice, and should not be considered a solicitation to buy or sell any security. Investing in the stock market and the bond market involves gains and losses and may not be suitable for all investors. Indices are not available for direct investment.

The BIP Wealth team is excited to announce that we have again been named by the Atlanta Business Chronicle as one of Atlanta’s Best Places to Work. Other honorees include Cox Enterprises, ParkMobile, Mark Spain Real Estate, and many more. We’re honored to rank in the top 3 for Medium-sized companies for fostering an environment that empowers our employees to grow and develop.

The companies were categorized by their size and nominated by their employees. Extra Large (500+ employees), Large (100-499 employees), Medium (50-99 employees), and Small (10-49 employees) companies were selected by the publication based on a number of factors, including employee engagement.

Last year, our team was honored as one of the top Small companies to work for. Backed by our incredible growth over the past year, we moved up into the Medium companies category. This is a huge deal for our team, to say the least.

“At the heart of every great company lies its people. We’re honored to once again be recognized by the Atlanta Business Chronicle as one of the best places not only to work but truly build a career. Our employees do so much for our clients, and we could not be more proud of the effort they put forth each and every day,” says Bill Harris, CFP®, Co-Founder and CEO of BIP Wealth. “It’s our collaborative spirit that guides our work. We challenge each other to be the best versions of ourselves each and every day and I’m so grateful to our team for always going the extra mile for our clients.”

While in the office, human connection is one of our guiding principles. In the same mindset as our client work, we want our colleagues to feel heard and be successful. To learn more about the award and why our team was recognized, be sure to check out our feature in the Atlanta Business Chronicle.

Founded in 2007 with offices in Atlanta, Alpharetta, and Nashville, we help our clients improve their financial lives through highly personalized and differentiated planning and investment strategies. Through comprehensive services which include wealth planning and management, estate planning, insurance planning, and more, we help our clients address their current needs and meet their future goals.

The following values guide our approach:

At BIP Wealth, we guide with humility and respect, committing ourselves to serving the needs and best interests of our many clients. It is through servant leadership that we provide holistic wealth management services that are formulated to help our clients fortify their financial well-being.

We leverage a team-centric mindset to foster an environment of open communication, combining our diverse expertise to create optimal financial strategies for our clients. Our collaborative approach also applies to our clients, where we create regular touchpoints to maintain a fully transparent wealth management process.

As part of our commitment to offer industry-leading services, we hold ourselves accountable to a relentless pursuit of excellence. Our team endeavors to not only guide clients through evidence-based investment strategies but also help them unlock opportunities in private equity, venture capital, and private credit that have historically been reserved for just the ultra-wealthy.

Within our team and among our clients, we do our best to foster a sense of belonging. We extend our family-first ethos to everyone who interacts with BIP Wealth, creating a strong and supportive community.

At BIP Wealth, we’re partners you can trust. To meet the experienced team of financial advisors that drive innovation and personal connections, head over to our Who We Are page. You can also contact us to connect with one of our advisors.

BIP Wealth Family,

As many of you know, our very own, Jim Poole, has been suffering from ALS over the last couple of years after being diagnosed in June 2021. It is with a heavy heart to let you know that Jim passed away last night.

His wife Kim was right next to him, holding him in her arms. She said he’s already organized a baseball game in heaven, so I can only imagine all the great players on both sides.

For those of you who didn’t have the pleasure of meeting or knowing Jim, he was one of the original investors in Buckhead Investment Partners, which became what you know today as BIP Wealth. He believed in the vision Mark Buffington and I shared and has continued to support us in so many ways over the years.

Jim came to work at BIP Wealth as a Portfolio Manager 14+ years ago with the idea to create a Baseball Division to reach current and former players like himself and their families. Over that time, he’s grown our Baseball Division to what it is today. Not only has he impacted the 100+ clients in our Baseball Division, but there’s another 150+ clients that showed up for the tailgate event we hosted last year, “ALS Night honoring Jim Poole” at the Georgia Tech baseball game.

His alma mater, Georgia Tech, wrote a beautiful tribute to Jim today on their website. You can read their post by clicking on the link below.

Kim and the rest of the Poole family appreciate all of the prayers and support over the last 2+ years, but we can’t stop now. Please continue to pray for the Poole family. Pray for peace, and pray for impact, as they continue to raise awareness about ALS.

If you would like to make a donation in Jim’s memory, Kim asked that contributions be made to the James R. “Jim” Poole Athletic Scholarship Endowment Fund. No amount is too small.

If you want to donate to ALS research, ALS Cure Project and ALS.org of GA are the two organizations that Jim and Kim were most closely aligned.

One more thing…several of us got to visit Jim in Hospice yesterday, which was great to see him before his passing. When I walked into the room, he was sporting a bright red, white, and blue PHILLIES shirt. As many of you know, Jim was a die-hard Philadelphia Phillies’ fan, so in Jim’s honor, even though it pains me to say, “Go Phillies!”

[The Braves play the Phillies tonight in the playoffs, so this game will have special meaning thinking about Jim.]

Thank you for being a part of our BIP Wealth family,

—Bill Harris, Co-Founder + CEO, BIP Wealth

We’ve also included below a note written by Mark Buffington, CEO of BIP Capital and Managing Partner of BIP Ventures. Both Mark and I were very close to Jim and will continue to think of ways we can honor Jim moving forward…

This morning, I received the sad news that Jim Poole passed away.

For those who don’t know, Jim was one of the first to invest in Bill Harris and me in 2007 when we started Buckhead Investment Partners (now BIP Wealth). He was one of 10 people who believed in our vision and wrote a check to help us get started.

Jim wasn’t just an investor; he was deeply involved in BIP’s success from the outset.

I will miss Jim. I have missed him over the last year as the effects of ALS limited his ability to interact. But I am somewhat comforted by the fact that he is no longer suffering.

To me, Jim Poole will always be royalty at BIP. He took a chance on us and then nurtured our success. We should all try to emulate the example he set.

Godspeed, Jim.

And to the Poole family, my sincerest condolences.

Mark Buffington

CEO, BIP Capital

Managing Partner, BIP Ventures

This quarter’s theme is, “How to Prepare for Market Disruptions.” Listen in as BIP Wealth’s Chief Investment Officer, Eric Cramer, covers what’s going on in the financial markets and how we’re advising our clients.

It’s one thing to have a vision for your wealth. But, in our complex financial landscape, where things can change in a heartbeat, it’s just as important to have a plan in place that takes a comprehensive approach. This is where the concept of holistic financial planning comes into play. Beyond taking a traditional view of finances—one that focuses solely on single aspects like investments, savings, or retirement—holistic planning has a more human approach and embraces a person’s lifestyle, priorities, and goals. It weaves together every financial thread of their life—from tax planning to investments to insurance needs—ultimately aligning each aspect with their unique financial circumstances. Because of this, holistic planning can not only enhance financial decision-making but can also help to foster peace of mind in the long term, knowing that every part of your financial life is working in harmony to potentially achieve long-term goals.

So, why might holistic wealth management be important to your success? In this blog, we’ll break down the top five reasons to implement a holistic financial strategy in navigating toward a secure, prosperous financial future.

For many, financial planning means more than just short-term stock returns. Perhaps you’re hoping to buy your dream home or car. Maybe you want to fund your child’s college education. You may even want to start a small business. Whatever the case may be, holistic planning can help you align with those goals in a more efficient way.

Now, what happens if your goals change? As you get older or the financial markets evolve, can holistic planning adapt to your new situation? Yes. Holistic wealth management from a firm like BIP Wealth can provide clients with a plan that is prescribed to be resilient to sudden changes such as dips in the stock market or higher taxes. Through these personalized plans, clients have the opportunity to establish a more resilient portfolio and lifestyle that can adapt to their evolving needs.

As life and the financial markets change with time, so should your wealth planning. A key value of holistic planning is its versatility, allowing both advisors and clients to make constant changes to target specific goals if needed. This flexibility is especially important for analyzing the global markets. The below graphic takes a look at the percentage of annual returns across a number of the world’s key markets, solidifying the need for a broadly diversified portfolio that can adapt to changing conditions.Source: Dimensional

Through a holistic financial plan, you may be able to achieve higher or more consistent returns as you focus on diversifying your portfolio to be more flexible. A study from Dimensional, a financial investment firm, found that from 1990-2020, investors looking to yield higher returns from global equities as well as global intermediate government and credit bonds would have performed better with holistic planning in most instances.

While thinking about your dream retirement or financial future can be an exciting time, it is also important to keep in mind the many risks that are associated with investing. Say you have a large chunk of your money invested in a single stock. At any given moment, that stock’s value could plummet, taking your hard-earned capital with it. That’s why a core element of a holistic planning philosophy should hold a somewhat pessimistic projection of the future. By actively thinking about how to properly react to inevitable market fluctuations, tax increases, or unexpected life shifts such as job loss, relocation, or injury, you can potentially limit your overall risk and set your portfolio up for a more robust future.

While it can be tempting to pursue high-risk, high-reward investments with quick payouts, holistic planning takes into account several other factors, especially when focusing on a sustainable, long-term gain, including one’s desire for a comfortable retirement or generational wealth transfer. Think of this like sitting in rush hour traffic, for example. You may quickly switch to a lane that is going faster only to find yourself at a standstill soon after. Although you might have temporarily moved ahead of some cars, they may end up beating you in the long run.

Holistic wealth management can include comprehensive plans that are built around passive income sources that drive a client’s retirement years or figure out the best way for them to enjoy their current lifestyle without having to continue their working days. By considering a client’s complete financial situation, holistic wealth management may help them accomplish more than just simple returns. Over the course of years, this system may help turn that dream retirement into an actual reality.

Finally, a component of a comprehensive holistic plan may aim to manage, control, and reduce your tax liabilities wherever possible. This is very important for estate planning and generational wealth transfers, as figuring out areas to reduce your tax burden can make a major difference over the years.

Our holistic planning formula blends Nobel Prize-winning empirical research with savvy integrations of alternative investments. Through our carefully-personalized plans, we’ve helped our clients unlock financial opportunities in both private and public markets that have historically been reserved for the ultra-wealthy.

At BIP Wealth, you’ll have access to a team of experts who will be with you and your family at every step of your financial journey. If you’re looking for a unique approach to holistic wealth planning, you can browse our offerings—from private equities, private credit offerings, public market investment plans, and covered call strategies.

What is holistic wealth planning?

Holistic wealth planning does not focus solely on singular investments, instead determining a person’s current financial situation, lifestyle, and ultimate goals to create a long-term plan for retirement, estate planning, investments, and more.

Why is holistic planning important?

From potentially limiting financial risk to better aligning with personal goals, holistic planning is important for those who are looking for more than just short-term investment returns.