January is the perfect time to start fresh and plan ahead for 2025. From ongoing changes in the market to the recent U.S. Presidential Election, there is a lot for both individuals and business owners to consider when reviewing their financial plans. From refining your investment strategies to ensuring your estate plan is up to date, a comprehensive new year financial checklist and review can uncover opportunities to strengthen your financial foundation. In this blog, we’ll discuss steps you can take to protect your wealth in the new year.

Because your goals act as the foundation for your wealth plan, the new year financial planning checklist is the perfect time to determine if anything needs changing.

Ask yourself a few of these questions: Are you on track to achieve your short- and long-term objectives? Do you need to adjust savings targets, diversify your investments, or reprioritize your spending? Reassessing your goals annually ensures you remain focused, intentional, and adaptable as you navigate the markets.

Although estate planning may seem like it’s only beneficial for those with significant net worths, we’d argue that it is important for everyone to regularly review (or establish). Life changes—such as marriages, divorces, births, or deaths—can impact your wishes, while shifting tax laws may create new opportunities or challenges. While going through your new year financial planning checklist, it may be in your best interest to revisit your estate plan to ensure it reflects your current circumstances and goals.

At BIP Wealth, we consider a wide range of factors when helping our clients plan their estate—from their unique financial goals to Power of Attorney and Healthcare Directives. Together, we’ll assist with your annual review to make sure you minimize your tax bill and help create generational wealth for your family.

While investing is a long-term way to build wealth, it is important to review your portfolio with your wealth manager when going through your new year financial planning checklist. Maintaining the right mix of investments such as small vs. large-cap investments, exchange traded funds (ETFs) vs mutual funds, and private vs. public investments, can help ensure you have a diversified portfolio to weather market fluctuations. During your new year financial planning, you can ensure your investments properly match your financial goals and are risk-tolerant. Rebalancing your portfolio can help restore the intended balance between stocks, bonds, and other asset classes, allowing you to manage risk effectively.

One of the best ways to build long-term wealth is through tax-advantaged accounts, such as 401(k) plans. These accounts enable your money to grow over time without the burden of hefty annual tax bills. In fact, regulatory changes in 2024 allowed investors to commit more money than ever to their plans, ensuring more wealth grows tax-advantaged.

For families, don’t overlook the power of Health Savings Accounts (HSAs), too. These accounts provide a triple tax benefit: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified expenses are tax-free.

If you have children who are planning on going to college, 529 plans are another great option to consider when going through your new year financial planning checklist. By utilizing accounts like these, you can fortify your wealth for the long term.

If you’re a business owner who offers or is looking to offer 401(k) benefits to your employees, it is not a set-and-forget type of strategy. One of the most important small business new year checklist steps is to benchmark your 401(k) plan. Why is this important? This can help you evaluate the costs of your plan and potentially find ways to reduce your tax bill. During the benchmarking process, your financial advisor will help you identify new investment opportunities to meet both your goals and the goals of your employees.

Finally, consider whether you’d like to set money aside for charitable contributions when going through your year-end financial checklist, as they can offer more tax benefits in the new year. You can also take advantage of the annual gift tax exclusion, which allows you to gift up to $18,000 (for 2024) per recipient without incurring gift taxes. If you’re married, you can double this amount by gifting jointly. This is an excellent way to transfer wealth to the next generation while minimizing taxes.

If you’re looking for holistic wealth management services like you read about above, be sure to reach out to our team. You can also check out our resources hub to learn more about the latest topics in the financial world.

It is important to establish a new year financial planning checklist that helps you identify financial planning opportunities, new investment ideas, and ways to minimize taxes. This can help you grow your wealth over time while losing as little to tax bills as possible.

A new year financial planning checklist can help you ensure your goals are being met and that your financial plan is sound.

Yes! For individuals, families, and business owners, consulting a financial advisor here at BIP Wealth can be a great way to simplify the process. Think of our team as your Personal CFO.

In life, things often change in a heartbeat. Unexpected life events can have serious financial consequences if not planned for. Whether it’s a medical emergency, job loss, or natural disaster, being financially prepared for life’s unexpected events is essential. The right planning can make dealing with unexpected life events less stressful, ensure you have proper cash flow, and even protect your wealth in the long term. In this guide, we’ll break down the importance of understanding unexpected life events and how to best plan for them.

Before we dive into strategies for dealing with unexpected life events, let’s first establish what situations you should financially plan for and why they’re important.

Although it is not easy, have you ever imagined a scenario in which a loved one suddenly passes away? What would be your financial plan? You may be left with a large inheritance. You may also have not been the main financial planner of the family. How would you go about accessing funds in a bank account or trust fund, for example? Without proper estate planning, which we’ll discuss later, you could be left in a financial situation that is tough to navigate.

Divorce can be a financially destabilizing event, often requiring the division of assets, legal fees, and more. When you factor in wealth, you must consider the complexities that come with dividing assets, such as real estate holdings, investment portfolios, and business interests. So, how can you best navigate this unexpected life event? For starters, a robust financial plan can be a major asset in helping smoothly navigate the significant life transition that comes with a divorce. It’s crucial to assess the impact of asset division on your long-term financial goals, including retirement planning and estate planning. Additionally, understanding the tax implications of asset transfers can help you strategize effectively to protect your wealth.

Disabilities caused by illness or injury could strike at any time. Financial planning for this unexpected life event can help those affected maintain the best possible standard of living, even in the event of lost income or wages. While you may have significant assets, ensuring that you have enough liquid funds to cover the immediate expenses of an unexpected life event is important to consider. When assessing your investment strategy, ensure a portion of your portfolio is easily accessible.

Did you know that 50% of all business transactions are involuntary? Disagreements between business partners can potentially threaten the business’s future, and therefore your personal financial goals as well. That’s why it’s important to have a detailed buy-sell agreement in place that outlines the terms under which a partner’s share of the business can be sold or transferred, preventing potential conflicts, ensuring business continuity, and protecting your legacy.

Economic downturns, natural disasters, and personal crises like job loss or major health issues can cause financial distress and unexpected cash flow needs. This can be mitigated by proactive measures that allow you to access capital when you need it most. So, let’s discuss ways that you can properly plan for unexpected life events.

When unexpected life events occur, a solid financial plan gives you more than just peace of mind. For many, it is the difference between having the right amount of money in place and not being able to properly pass wealth down to their families.

If you’re a business owner, ask yourself some of the following questions: Am I prepared to retire? Who will succeed me in leading the business? Do I need any support from my financial advisor? A comprehensive review of your business plan could be a great way to avoid any financial pitfalls caused by an unexpected life event such as death or disagreement.

On top of this, it is important to ensure you’re properly bankrolled for your retirement years. This will help you and your loved ones access money in the event of any unexpected life events which may occur in your later years.

Another great strategy for staying one step ahead of unexpected life events is estate planning. This is a crucial part of any long-term financial plan. It involves creating legal documents such as a will, trusts, and power of attorney, which provide clear instructions on how your estate’s assets are to be distributed.

Without an estate plan, your assets could be subject to lengthy probate processes, potentially causing financial strain and uncertainty for your loved ones. On top of this, you may be paying more in taxes on your estate than you could with the right plan. For example, passing down certain assets to loved ones before death could help you receive different tax breaks.

It is important to regularly review your estate plan with your BIP Personal Wealth Advisor to ensure it remains up-to-date at all times.

In some cases, insurance coverage can be the best way to deal with unexpected life events. Imagine a scenario such as a car accident or house fire. Without proper insurance coverage, the financial burden could be life-altering. Imagine if you and your family lost a vacation home to flooding, for example. Insurance could be the safety net that protects you and your family from significant financial loss due to unexpected expenses.

Consider life insurance in addition to traditional coverage such as home, auto, and health. If you’re the main earner of your family, life insurance can help keep your loved ones taken care of in the event of your unexpected passing or injury.

On top of the strategies listed above, planning for life’s unexpected events can be difficult alone. At BIP Wealth, our holistic and empathetic approach to financial planning ensures that every client’s financial needs are handled with personalized care. From inheritance management to estate organization to financial education, we help individuals, families, and businesses navigate the waters of unexpected expenses and life-changing events—whether you’ve recently lost a loved one, won the lottery, or sold a business. Through expert guidance and risk management, our team of experienced financial advisors will help keep your hard-earned assets protected under any circumstance. To learn more about our team or speak with an advisor, feel free to contact us at any time.

Unexpected life events include things such as injury, divorce, disagreement, and more. Financially, these events can be life-altering.

To best prepare for unexpected life events, it is important to have a financial plan in place ahead of time. This plan can include insurance coverage, income diversification, and estate planning to ensure you and your loved ones can access funds in times of need.

Those who assume unexpected life events will not occur to them tend to be the hardest hit. It is important to assume you will need financial support at certain times of your life, even if you never end up needing the help.

Examples of life-changing events include death, divorce, auto accidents, and plenty more. These events could bring financial and emotional stress.

This communication contains general investing information that is not suitable for everyone and is subject to change without notice. Past performance is no guarantee of future results and there is no guarantee that any views and opinions expressed will come to pass. The information contained herein should not be construed as personalized investment advice, tax advice, or financial planning advice, and should not be considered a solicitation to buy or sell any security. Investing in the stock market and the bond market involves gains and losses and may not be suitable for all investors. Indices are not available for direct investment.

We are thrilled to announce that for the third year in a row, BIP Wealth has been recognized by the Atlanta Business Chronicle as one of Atlanta’s Best Places to Work, marking another milestone in our commitment to excellence. This year, we proudly rank #1 for Medium-sized companies, standing alongside other esteemed honorees such as Peachtree Planning Group, Snellings Walters Insurance Agency, and CA South, LLC. This recognition is particularly meaningful as it reflects the trust and satisfaction of our most valuable asset—our employees.

For our team, this accolade is not just about having a great workplace—it’s about the culture we’ve cultivated along the way. Human connection is at the core of our philosophy, both in our client work and within our team. We believe that when our employees feel valued, heard, and supported, they are empowered to deliver exceptional service to our clients.

“We’re honored that BIP Wealth has been recognized for the 3rd year in a row by the Atlanta Business Chronicle as one of the best places to work and this year as #1! Our venture capital firm, BIP Ventures, also made the rankings in their category this year, which is exciting too,” shared Bill Harris, CFP®, Co-Founder and CEO of BIP Wealth. “When Mark Buffington and I started BIP together in 2007, we wanted to create a culture of excellence in service to our clients and our team members at the firm. It’s particularly meaningful to me that both BIP Wealth and BIP Ventures are being recognized for one of our key values… a team-centric approach that fosters an environment of open communication and excellence. Our team supports each other and goes the extra mile for our clients.”

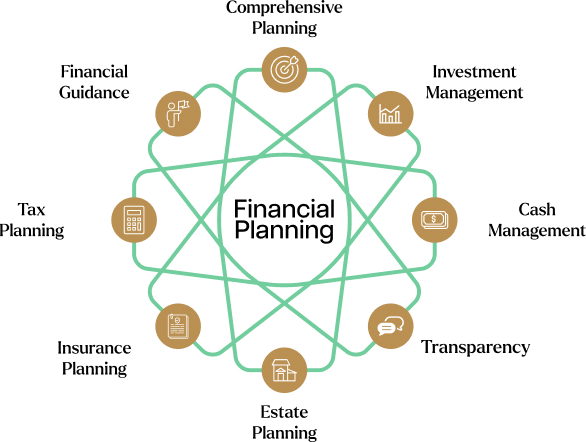

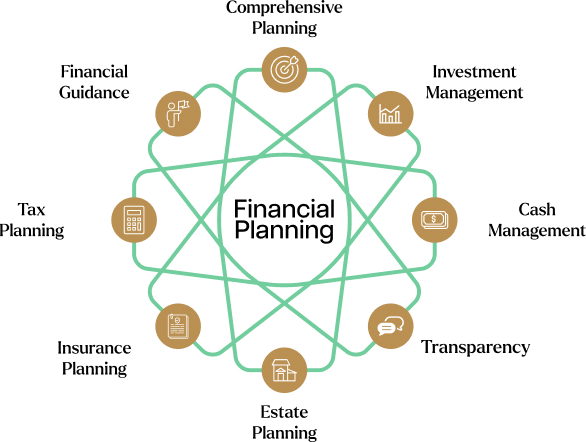

Founded in 2007, BIP Wealth is committed to improving our clients’ financial lives through highly personalized planning and investment strategies including direct and unique access to private market opportunities. Our comprehensive services include wealth planning and management, tax planning, estate planning, and more, and are designed to meet our clients’ current needs and future goals.

“Not only does our team work exceptionally hard for our clients, they’re also all incredible people,” adds Nate Smith, BIP Wealth Chief Operating Officer. “The community that Bill has cultivated within our team, clients and partners makes BIP a very special place to work.”

Servant Leadership: We lead with humility and respect, always putting our clients’ needs first. This commitment to servant leadership enables us to provide holistic wealth management services that strengthen our clients’ financial security.

Collaboration: Our team-centric mindset fosters an environment of open communication, blending our diverse expertise to create optimal financial strategies. We extend this collaborative spirit to our clients, ensuring a transparent wealth management process.

Excellence: We are relentless in our pursuit of growth with excellence, holding ourselves accountable to delivering industry-leading services. Our team guides clients through evidence-based investment strategies while unlocking opportunities in private equity, venture capital, and private credit typically reserved for the ultra-wealthy.

Sense of Community: We foster a sense of belonging within our team and among our clients. By extending our family-first ethos to everyone who interacts with BIP Wealth, we create a strong, supportive community.

At BIP Wealth, we’re not just a company; we’re a community of professionals dedicated to empowering each other and our clients. We invite you to learn more about our team and what makes BIP Wealth a special place or connect with our team. You can also visit us in person at one of our offices in Atlanta, Alpharetta, Columbus, and Nashville.

This recognition from the Atlanta Business Chronicle reaffirms our commitment to excellence, both in the workplace and in the services we provide to our clients. We look forward to continuing this journey together with our incredible team and valued clients.

Disclosure: BIP Wealth paid an application fee to be considered for the list, but the payment didn’t guarantee a place on the list. Companies are categorized by their size and nominated by their employees. Extra Large (500+ employees), Large (100-499 employees), Medium (50-99 employees), and Small (10-49 employees) companies were selected by the publication based on a number of factors, including employee engagement.

ATLANTA — BIP Wealth is proud to announce the hiring of veteran Atlanta Estate Planning Attorney, Sarah Watchko to the role of Estate Planning Advisor. Over the past several years, BIP Wealth has collaborated with and referred clients to Sarah for Estate Planning creation and execution. Sarah will now lead the way in building out this important expertise in-house for BIP clients.

Sarah developed a passion during Law School for working with elderly clients and for clients who have a child with special needs. This was while she was working at the Elder Law Clinic at Wake Forest University in 2007. This led her to discover a career in estate planning, special needs planning, and elder law that could provide both intellectually demanding work and the opportunity to serve and improve the lives of others. Sarah finds immense joy in providing a high level of service, along with a calm and comforting demeanor to those navigating life’s challenges.

As a client of BIP, Sarah and her husband Jeff know firsthand the care BIP has for their clients but she never dreamed of joining the Team. “BIP’s CEO Bill Harris probably asked me about 15 – 20 times to consider joining the firm and I turned him down every time because I was happy in my previous role,” shared Sarah. “However, the more I learned about the role and what it could look like to build this for BIP’s clients from the ground up, it was clear this is an opportunity I couldn’t say no to.”

Sarah is particularly passionate about working with families navigating the complexities of special needs and hopes to elevate BIP as the go-to resource for those families in the Atlanta area. The greatest compliment she can receive is when a client shares, “You’ve taken the worry off my shoulders knowing the people I love most are protected.”

“We are honored that Sarah said yes to joining BIP and building out our Estate Planning Services! The care she provides clients aligns with our firm’s values perfectly,” shared Bill Harris, CFP®, Co-Founder & CEO of BIP Wealth. “I am excited for our future and all the ways this new internal capability will benefit the families at our firm in having peace of mind to be prepared for the future.”

An Atlanta native, Sarah lives in Roswell with her husband Jeff, son, daughter, and their loving mutt, Hank. She and her brother William attended Marist School in Atlanta. Both her brother and husband were collegiate athletes at Georgia Tech who went on to play professionally (the former football and the latter, baseball). Both families remain avid Georgia Tech fans. Sarah loves reading, spending time with friends and family, staying active, travel, and—in her rare free time—squeezing in a craft or baking project.

Are you an investor? Are you looking to start investing? Creating a holistic financial plan can be daunting for investors, especially those who may be new to the industry. Objectives and markets can change in a heartbeat, making holistic financial management and investment planning a crucial part of any successful portfolio. So, what directions can investors go in? What should they know?

In this guide, we’ll discuss everything from Roth IRA strategies to the differences between investment management vs. asset management. Let’s start by first analyzing your current financial plan and why it may be dangerous in today’s markets.

No two financial plans are created equal. While your main goals might look similar to someone else’s, their investment strategy may not fit your unique financial situation. There are five main aspects to consider when first analyzing your financial management, and it all starts with planning—or struggling to plan—for the future.

Rewind five or ten years. Did you know then what you would be making today? And that can include your salary, investment returns, or any other form of income. An issue some investors may run into is that their current financial management assumes that they will continue to make a healthy amount of money. If your income suddenly slashes, it could seriously impact your retirement. So, to counteract this, it is important to establish what your “worst-case” scenario is. This can help you and your financial advisor create multiple plans of action to solidify your retirement goals.

When you first began investing, did you consider the outside costs that come with owning assets such as stocks? This is another mistake that is easy for new investors to make when considering their financial management strategies. For example, you could end up paying 2% or more in total investment expenses if your plan assumes that there are zero investment expenses out there.

Do you make this common financial management mistake? Your stock portfolio gained 20% in the previous fiscal year and you decide to sell most of it off at reposition. With a 4-5% tax hit, that 20% will look more like 15% when it is all said and done. Short-term gains are taxed at a higher rate, so it is important to consider the financial impacts of taxes before you decide to sell a large chunk of your investment portfolio.

For older investors, social security could be a great way to have a fantastic retirement. You paid your dues and now have the chance to be financially comfortable after you finish working. A lot of others, however, may not get this luxury. According to the 2023 Annual Report, the program may exhaust itself by 2033, meaning benefits may take a massive hit. For younger investors, it is important to plan for retirement without the traditional social security benefits we’ve known.

The final mistake investors make, by no true fault of their own, is not dying on schedule. The best financial management and investment strategies may plan for a life expectancy that you only have a 10% chance of achieving to account for the possibility of a longer life.

Now that we’ve identified some of the common pitfalls investors may face when building their investment strategies, let’s take a look at the core pillars of financial management. It all starts with establishing what the right plan is for your personal goals.

There are several ways you can manage your financial and investment strategies in today’s market. Two of these include investment management and asset management. So, which one is right for you? The answer depends on your ultimate investing goals.

Versus asset management, investment management involves handling financial assets and investments, going beyond mere stock trading to encompass budgeting, tax strategies, and more. It’s about strategically managing a portfolio to meet specific wealth accumulation goals through informed buying, selling, and holding based on market research and economic analysis. Pros include tailored strategies and active management.

Asset management, often used interchangeably with investment management, extends beyond securities to encompass real estate, commodities, and other assets. It focuses on understanding an investor’s goals for long-term capital growth, rather than short-term stock market gains. Asset management provides a holistic financial management experience, considering a wider array of holdings and needs.

If you’re looking to grow your wealth through financial management that encompasses primarily stocks and bonds, you may lean more on the side of investment management vs. asset management. However, if you already own many valuable assets such as homes, cars, and investments, asset management may be the way to go. If you’d like to talk with a trusted BIP Wealth advisor to learn more about these two strategies, please contact us.

Once you’ve identified whether you prefer investment management or asset management, it’s important also to consider the pros and cons of portfolio management and wealth management. These two strategies give investors two different paths for growing their wealth over time.

Compared to wealth management, portfolio management involves crafting a tailored financial plan considering risk and reward, aiming for high returns while managing overall risk. There are four types: active, passive, discretionary, and non-discretionary. Active management seeks to beat market benchmarks, while passive aims to match them. Discretionary managers make decisions independently, while non-discretionary managers require client input.

Wealth management, however, is a much more holistic financial management plan. This approach offers a broader spectrum of services compared to portfolio management, aiming to tailor strategies to clients’ diverse needs and long-term goals. It encompasses investment strategies, retirement planning, and more, ensuring holistic wealth growth and protection. Core elements include financial planning, asset allocation, asset management, estate, and tax planning.

Maintaining an investment strategy that can provide the best risk versus return is something that is always on the minds of investors today. So, how do Roth IRA strategies come into play? To start, they can help investors minimize the amount of tax drag, resulting in increased tax alpha. Effective Roth IRA strategies, if managed correctly, can potentially eliminate taxes. Since 1998, legislative changes have increasingly favored affluent investors in utilizing Roth IRAs. Investment managers can capitalize on these changes to enhance tax alpha for clients, often in collaboration with tax advisors. These strategies are generally low-risk and are welcomed by tax advisors aiming to minimize clients’ tax burdens.

To boost your Roth IRA strategies, the most basic technique is increasing the amount of money you put into it. As of 2024, the contribution limits are $7,000, with an additional $1,000 for folks over the age of 50.

Now that we’ve covered the basic aspects of financial management, let’s shift our focus to how to shape your investment strategies.

Defining what you want to accomplish through financial management is a critical first step to building a successful strategy. Do you have any existing assets you’d like to include in your financial management strategy? Are you looking for short-term gains? Long-term? These are just a few of the questions you should consider as you plan with your financial advisor as they help you get a clearer picture of your current and desired financial wealth status.

Once you’ve established your plan and set your overall goals, the next step is to figure out what you can and can’t afford to include in your financial management strategy. Budgeting helps you understand your income and expenses, giving you a clear picture of your financial situation. Budgeting for your investment strategy can also help you free up funds that can be directed towards investments, whether it’s in stocks, real estate, or retirement accounts.

Investing is not guaranteed to succeed. As a result, it is important to understand where you stand regarding risk. How much could you afford to lose if a stock price suddenly dips? Is your portfolio diversified to handle the rise and fall of stock prices? Managing risk can help investors maintain financial stability, both in the short and long term.

With the above information in mind, now it’s time to implement your investment strategy. There are a few critical steps to follow, the first being to have a critical eye when identifying your desired path forward.

To use a sports analogy, let’s think of your financial management strategy as a game of football. As the head coach of your wealth growth, it is important to think strategically about every move you make to ensure it aligns with your ultimate goals. At BIP Wealth, our advisors focus on factors such as investments, risk, and changing markets to quarterback your portfolio to success and act as your personal CFO.

We mentioned earlier in this guide that Roth IRA strategies can be the “holy grail” of tax-smart investing. By diversifying your investment strategy portfolio with retirement in mind, you can help establish long-term financial success for you and your loved ones.

Once you’ve nailed down your strategy, it is important to ensure your financial management strategy is robust and versatile. Set short and long-term goals for yourself, be specific in your objectives, and always account for taxes and inflation, as the two can dramatically affect your investment strategies at any time.

Keeping track of your financial management can be tricky. There are ways to streamline this process, however. At BIP Wealth, our proprietary platform—BIP ClientCare—helps clients manage and monitor your wealth. Talk to your advisor about how this tech platform can be utilized to help you.

At BIP Wealth, our trusted team of advisors helps clients achieve long-term financial success through holistic wealth planning that puts your personal goals and needs at the top. To learn more about our story and how we’re engineered to perform for you, be sure to get in touch with an advisor today. You can also check out our news and blog section to learn more about the headlines dominating the financial world today.

The main goal of financial management is to maximize the value of an organization or individual’s financial resources while mitigating risk.

Financial management, when done right, can help investors and organizations effectively manage their resources, make informed financial decisions, and plan for their financial future.

Financial strategies could include portfolio and wealth management, Roth IRA strategies, and even investment and asset management.

While answers will depend on your personal goals and financial situation, it’s good practice to budget for and track your investments over time.

Start by setting your goals and planning out a budget. From there, it’s all about creating the right investment strategy that sets you up for short and long-term success.

This communication contains general investing information that is not suitable for everyone and is subject to change without notice. Past performance is no guarantee of future results and there is no guarantee that any views and opinions expressed will come to pass. The information contained herein should not be construed as personalized investment advice, tax advice, or financial planning advice, and should not be considered a solicitation to buy or sell any security. Investing in the stock market and the bond market involves gains and losses and may not be suitable for all investors. Indices are not available for direct investment.

BIP Wealth is proud to announce the recent promotion of Jenni Brown to the role of Chief Marketing Officer (CMO). In the CMO role, Jenni continues to spearhead all strategic marketing initiatives for the firm, adding to the groundwork she made as Marketing Director for the past two years, where she advanced BIP Wealth’s reputation as a national leader in the wealth management industry.

“Jenni’s immediate impact to our brand and culture cannot be overstated,” says Nate Smith, COO of BIP Wealth.“ Since she joined our team in 2021, she has worked tirelessly to drive our brand forward by elevating the client experience, improving the office environment, and providing crucial marketing insights. Jenni’s promotion recognizes her tremendous contributions to date and her daily leadership throughout the organization.”

Throughout a career that spans over 20 years, Jenni has spent countless hours building lasting relationships and pursuing meaningful work at organizations such as Passion City Church, The END IT Movement, and Leader Enterprises. Jenni plays a crucial role in planning BIP’s dozens of client events annually, fostering a sense of community within its client base, managing its agency relationship with Marketwake, and revamping all of BIP’s marketing collateral, digital properties—including website and social media presence, and physical environments.

“I am thrilled to have found a home on the team at BIP Wealth where I can continue to grow in my career while serving our team and incredible clients,” shares Jenni. “The emphasis we as a firm put on people first starts at the top and makes for a positive place to work. I feel so lucky and motivated to continue to push our brand forward. As Mark Buffington, Co-Founder of BIP Wealth and CEO of BIP Capital says, ‘BIP Wealth is the best-kept secret in wealth management’ and I want to let more people in on that secret!”.

As CMO, Jenni will leverage her extensive experience in marketing, design, communications, events, and PR to drive brand awareness, enhance engagement with clients, and cultivate meaningful relationships with stakeholders. Her incredible leadership abilities and visionary approach will play a pivotal role in advancing BIP Wealth’s growth objectives in the future and beyond.

The BIP Wealth team is honored to be named in Wealth Management IQ’s “RIA Edge 100” list. The list recognizes wealth management firms that have grown fast while always keeping the needs of their clients top-of-mind.

“We are delighted to be named to the RIA Edge 100 list. On top of recent honors from USA Today and the Atlanta Business Chronicle, seeing our firm’s name on Wealthmanagement.com’s list means everything to us,” Bill Harris, Co-Founder and CEO of BIP Wealth, said. “BIP Wealth’s top priority has and will always be serving our wonderful clients. Our firm’s continued growth is all thanks to the faith they have shown in us to manage their hard-earned wealth.”

Developed by Wealthmanagement.com’s research team in partnership with ISS MI, the list was created using data from the Discovery Data MarketPro platform.

To start, the RIA Edge 100 list is not a traditional award as RIAs cannot apply for this list. Additionally, they are not considered based on factors such as social media popularity or business relationships. The list comes down to the top 100 firms that display healthy growth and a true commitment to serving clients.

This means a lot to our team, as we did not submit anything to be considered for this honor.

“Knowing that BIP Wealth made the list because of our hard work is something to celebrate,” said Harris. “We hope to remain on the RIA Edge 100 list for years to come.”

So, how did BIP Wealth qualify for the honor?

The first metric the Wealth Management IQ research team used was whether the RIAs they analyzed were SEC-registered. Qualifying firms were also required to have high-net-worth individuals as part of their client base and manage at least $500 million in assets.

This metric is important for our team as it helps spotlight our firm’s growth. We’ve grown to $3.3B AUM at BIP Wealth, and are excited and honored to continue growing.

As the RIA Edge 100 list is data-backed, key metrics such as AUM (assets under management) growth over one and five-year periods, the ratio of employees to clients, and the average size of client portfolios were also considered. At BIP Wealth, we are also driven by data. Our wealth-creation engine leverages innovative technology and financial forecasting to help our clients personalize their wealth plans for future success.

At BIP Wealth, we combine precise financial science with the wisdom of industry experts to help our clients grow, manage, and protect what’s most important. For the past few years, we’ve been fortunate to have seen such growth in our assets under management, client base, and staff. From opening new offices in cities like Nashville to growing our BIP Wealth Baseball Division and acquiring a new RIA, we’re excited about what’s in store over the next few years.

“BIP Wealth would be nothing without our amazing clients and we cannot wait to continue serving them,” Harris said. “Making the RIA Edge 100 list will only motivate our team further.”

If you’d like to learn more about our firm or speak directly with an advisor, please reach out to connect with us. You can also check out our resources page to learn more about what’s new at BIP Wealth and in the financial industry.

Disclosure: The data for the ratings was as of 1/1/2024. BIP Wealth did not apply to be considered on the RIA Edge 100 list, nor did they provide any compensation in order to appear on the list.

BIP Wealth, recently named on wealthmanagement.com’s RIA Edge 100, as well as the top 3 on the Atlanta Business Chronicle’s 2023 Best Places to Work list for medium-sized companies, is proud to welcome the addition of former MLB outfielder Jeremy Hermida to its Baseball Division as Business Development Officer. Hermida joins former Pro Baseball players Kyle Schimdt, CFP®; John Hester, CFP®; and Chase Murray in the Baseball Division founded by former Major League Baseball pitcher Jim Poole.

Hermida was the Marlins’ No. 1 draft pick (11th overall) in the 2002 Major League Baseball draft and one of the highest-rated minor league players throughout his 3-year ascent to the MLB. He went on to play professionally for 14 years, 6 of which were in the majors for the Florida Marlins, Boston Red Sox, Oakland Athletics, Cincinnati Reds, and San Diego Padres. He ended his professional playing career in 2015 in Japan with the Hokkaido Nippon Ham Fighters.

Having Jim Poole as one of his personal and professional mentors for 7+ years, Hermida knew he wanted to be more involved with the Baseball Division at BIP Wealth. With his deep admiration and firsthand knowledge of the importance of having exquisite financial advice and guidance, it was an easy ‘yes’ for Hermida to move from being a client of BIP to joining the team. He considers his current role both an honor and a calling.

BIP Wealth’s Baseball Division provides investment management and sophisticated planning solutions geared towards the goals and objectives of draft-eligible, current, and retired professional baseball players and their families. Hermida is uniquely positioned to help guide clients through their journey of life on and off the field.

“BIP is in a class of its own when it comes to client care and expertise, and I am thrilled to be a part of the team,” said Hermida. “Being mentored by Jim Poole helped lead me to where I am today on the team. I started with a few private investment deals as a hobby and became more and more interested after my playing days. I’m so ready for this second career and the chance to take a more hands-on approach to guiding current and former players and their families as they prepare for the future.”

“Jeremy has been a part of the BIP Wealth family for the past 7 years as a client. We’re excited that he’s decided to take this next step in his post-playing life by joining our Baseball Division,” shared Bill Harris, CFP®, Co-Founder & CEO of BIP Wealth. “Jeremy has played baseball all over the world, so he knows first-hand the ups and downs of a professional career. His extensive playing experience and financial aptitude will be a strong addition to our team. The future success of BIP Wealth’s Baseball Divison just took a big step forward.”

Hermida lives in the Dunwoody area with his wife of 12 years, Lindsey, and their son and two daughters. Born and raised in Marietta, Hermida went and married a northern Jersey girl, so you can find them splitting their summer vacations between the south and the north.

Contact Jeremy: Jeremy Hermida, BIP Wealth Baseball Division, Business Development Officer

Press Contact: Jenni Brown, Chief Marketing Officer