Welcome to another BIP Wealth Quarterly Market Report with Eric Cramer, CFP®, CFA®, Chief Investment Officer. In his Q3 2024 report, Eric walked us through his economic summary from the past few months, including a timeline of major events and the performance of the U.S. Stock Market.

In case you missed the presentation, we’ll go over the main talking points below. You can also watch the recording of Eric’s presentation below.

The Recap: Fairly Calm, Until Now!

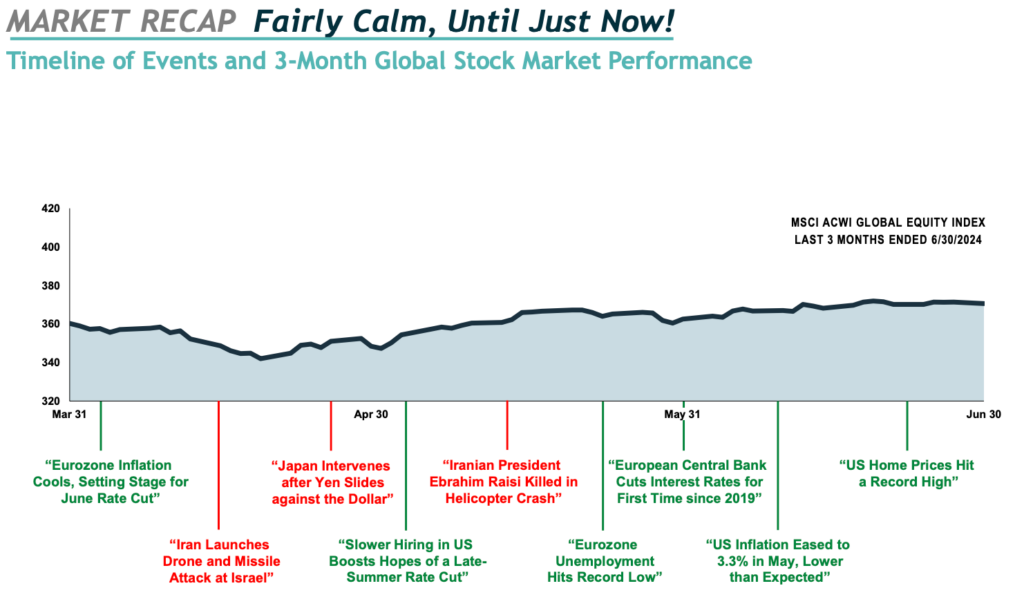

When you look back on the key events that happened in Q2, you’ll notice that the markets remained very calm throughout much of the process. Two major headlines stood out when analyzing the market’s overall performance. The first was Japan intervening against the Yen as it slid relative to the U.S. Dollar. However, this was not “new” news to those in the financial world. We knew this was coming and had a solid plan in place to tackle the market volatility that followed.

The second major headline centered around U.S. hiring rates slowing, boosting hopes of a late-summer rate cut. This was another development we saw coming, as the labor market was overdue for a dip. This is all to say, don’t follow the doomsday headlines too closely. So long as you have a versatile financial plan in place, there are ways to navigate market volatility.

Looking at our blended benchmark results, the Q2 numbers don’t tell the whole story. While the fixed income index is negative, our clients have done substantially better since we don’t take the same risks. Additionally, the global equity index’s YTD performance sits at 10.28%. So, if you thought these numbers were pretty good for being halfway through 2024, they’re even better now as we plow our way through Q3.

The Market Outlook: Fed “Put” vs. Volatility

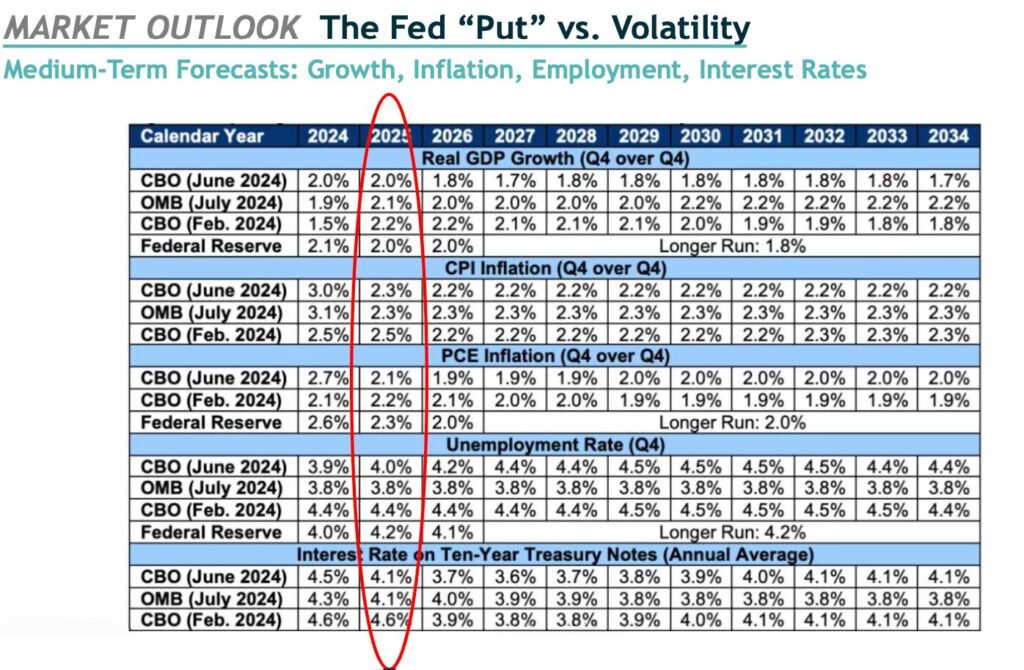

The first thing to look at when discussing Fed “Put” vs. volatility is what we call “Medium-Term Forecasts”. In the report, Eric highlighted the projected 2025 numbers for the most important economic issues, such as real GDP growth (over the rate of inflation) and the unemployment rate. What the numbers show is that nobody is truly predicting an economic recession, even though you may continue to see this in the news headlines.

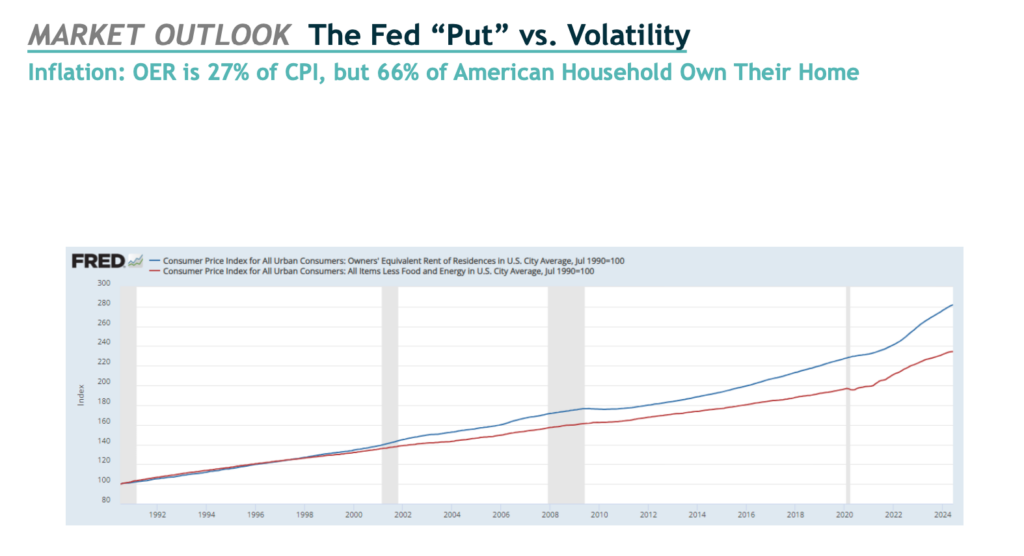

It’s also important to look at inflation in U.S. housing. While many of us have become addicted to reading the latest numbers, Eric discussed why the Consumer Price Index (CPI) rate, as shown in the graph below, is not the best indicator of inflation. This is due, in part, to 66% of American households owning their own home instead of renting. When the value of homes goes up, they are not affected like renters are. As a result, we should not be surprised to see negative CPI numbers in the near future.

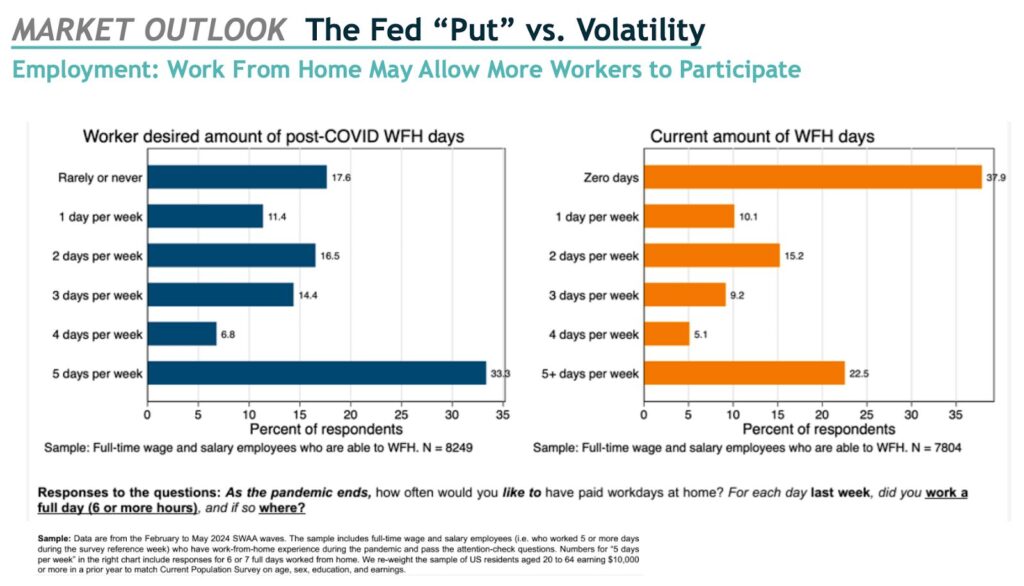

Additionally, the significance of working from home could impact the job market, as it may allow more to participate. Despite what you may hear, we currently have an abundance of open job positions waiting to be filled. And the data shows that companies are offering work-from-home benefits that are very similar to what the current workforce desires. The chart below highlights these numbers further.

The Final Thoughts

Before signing off, Eric left our clients with his three biggest talking points for Q3. The first is that our economy is fundamentally strong. Every broad measure of our economy is healthy at the moment, although there are specific issues such as inflation in housing that are affecting some. The second is that we will survive the upcoming election in Q4. It’s easy for certain individuals such as economic analysts to mislead their audience with a political agenda. Remember that if you’re only looking at one news source, you’re only getting one side of the story. Always be on the lookout for the truth. Finally, BIP continues to add new tools to the toolbox. The BIP Short-Term Tactical, for example, takes advantage of the current yield environment to pursue capital preservation while seeking yields meaningfully higher than what most banks can offer.

If you’d like to speak to an advisor about your portfolio or want to learn more about how we’re engineered to perform for our clients, be sure to contact us. You can also check out the rest of our resources hub to learn more about the financial market.

Questions Asked:

- Since private equity is considered higher risk, why would we allocate dollars into it and how does that fit into a portfolio?

BIP Wealth invests in private equity differently than the industry. We have direct access to private market opportunities through our venture capital firm, BIP Capital. We have a rigorous investment committee process where we vet various private equity opportunities, that are in it for consistency. We have a different approach from standard private equity investing and use financial planning software to perform a thorough analysis of each client’s financial situation, so we’re not taking uncompensated risks.

- What percentage of your portfolio should be in private equity and what criteria do you use to get to that number?

BIP Wealth has models in our financial planning process that can provide baseline recommendations of allocations for private equity investments. However, it all depends on your personal circumstances. We make adjustments for different factors including life expectancy, liquidity needs, and your understanding of the market and how it works.

This communication contains general investing information that is not suitable for everyone and is subject to change without notice. Past performance is no guarantee of future results and there is no guarantee that any views and opinions expressed will come to pass. The information contained herein should not be construed as personalized investment advice, tax advice, or financial planning advice, and should not be considered a solicitation to buy or sell any security. Investing in the stock market and the bond market involves gains and losses and may not be suitable for all investors. Indices are not available for direct investment.