During BIP Wealth’s recent Quarterly Market Webinar, Eric Cramer, CFP®, CFA®, BIP Wealth’s Chief Investment Officer shared a timely and insightful update that focused less on artificial intelligence this time—and more on what’s truly shaping today’s economic environment. The session was divided into three parts: a strategic review of BIP Wealth’s 2025 market themes, a recap of Q1’s market behavior, and a look forward at the implications of reemerging global tariffs.

In case you missed the presentation, we’ll go over Eric’s main talking points. You can also watch the recording of the presentation..

Below is a breakdown of the key themes covered and how they apply to investors.

Eric shared that investors must reconsider their approach to risk in 2025. The first quarter highlighted vulnerabilities in public markets, especially within tech-heavy portfolios. While some investors remain heavily tilted toward growth stocks, Eric emphasized the importance of rebalancing portfolios to include more resilient, diversified holdings.

Private markets—especially private credit—are a critical part of this evolution. Many investors still have limited exposure to private credit, even though it can offer income stability and reduced correlation to stock market swings.

BIP Wealth has the tools in place to help clients diversify effectively. Beyond asset classes, our message is also about planning discipline: investors should align their portfolios with long-term goals, not short-term trends. Eric cautioned against assuming that more risk automatically means more return, especially when individual plans might already be on track with more moderate exposure.

“Financial plans should guide risk, not the headlines.”

In the next section, Eric covered the notable movements from Q1 2025. The standout theme? Technology stocks saw significant declines, disrupting the market’s previous growth-led narrative. Simultaneously, the U.S. dollar experienced a noticeable drop, adding complexity to global investments.

The volatility seen in early April raised concerns, but a rebound later in the month provided perspective. Despite dramatic swings, the market returned to roughly where it started by the end of April. This whipsaw behavior reinforced why tactical shifts alone aren’t sufficient: portfolios need long-term resilience, not just short-term reaction.

For active observers, this served as a reminder that recovery often follows volatility—but only disciplined, diversified portfolios benefit consistently over time.

Finally, Eric wrapped up this quarter’s report with a segment dedicated to tariffs. While trade policy developments are complex and far-reaching, here’s an overview of what matters now:

Global economic friction is back, and it needs to be factored into asset allocation decisions. It’s not just about what’s growing—but what’s being taxed, restricted, or redirected.

Eric closed by encouraging every client to revisit their financial plan. Too many investors are still positioned based on outdated assumptions—chasing growth or risk without considering whether it’s necessary for their goals.

Drawing comparisons to pre-2008 planning errors, the team warned against overreaching. Many clients could meet their objectives with lower risk—provided they embrace more balanced, well-structured portfolios that incorporate alternatives and downside protection.

“You don’t need to ride the roller coaster if your goals don’t require it.”

This quarter’s report made one thing clear: in a year of shifting risks—tech pullbacks, currency changes, and geopolitical trade pressures—flexibility and discipline matter more than ever. BIP Wealth continues to evolve its strategies to help clients thrive through the uncertainty.

If you’d like to speak to a Personal Wealth Advisor about your portfolio or want to learn more about how we’re engineered to perform for our clients, be sure to contact us. You can also check out the rest of our resources hub to learn more.

This communication contains general investing information that is not suitable for everyone and is subject to change without notice. Past performance is no guarantee of future results and there is no guarantee that any views and opinions expressed will come to pass. The information contained herein should not be construed as personalized investment advice, tax advice, or financial planning advice, and should not be considered a solicitation to buy or sell any security. Investing in the stock market and the bond market involves gains and losses and may not be suitable for all investors. Indices are not available for direct investment.

Welcome to our final BIP Wealth Quarterly Market Report of 2024 with Eric Cramer, CFP®, CFA®, Chief Investment Officer. In Q4’s report leading up to the 2024 U.S. Presidential Election, Eric starts with a look at historical trends under each presidential administration dating back to 1926 and touches on other key economic data points.

In case you missed the presentation, we’ll go over Eric’s main talking points below. You can also watch the recording of the presentation below.

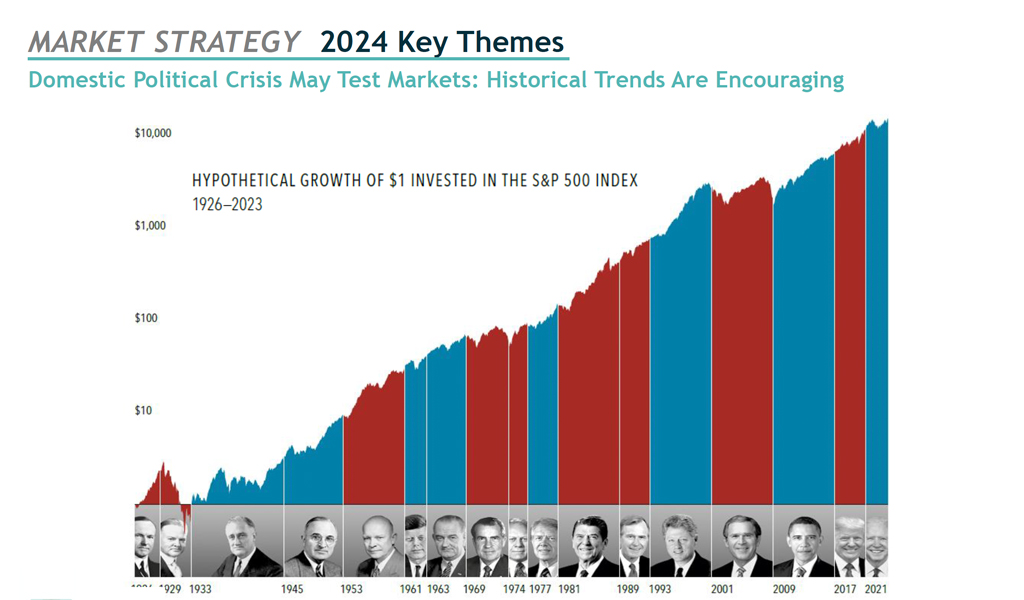

With the upcoming 2024 U.S. Presidential Election, we know that a political crisis may test the market. Eric encouraged everyone to take a moment to put on their investor hat. From that more narrow perspective, Eric reviewed the history of the S&P 500 to see how that’s performed over history in the context of who is in the White House. What we see is that markets have gone up over long periods of time under every administration. The point is to remind people that when you’re investing in the stock market, you’re really investing in a much larger system than who is in office at any particular time. You’re investing in democracy, you’re investing in capitalism, you’re investing in the ingenuity and entrepreneurialism of the U.S. in particular. It’s an investment and trust in a system that’s bigger than any one particular candidate.

Source: BIP Wealth Quarterly Market Report, Q4 2024

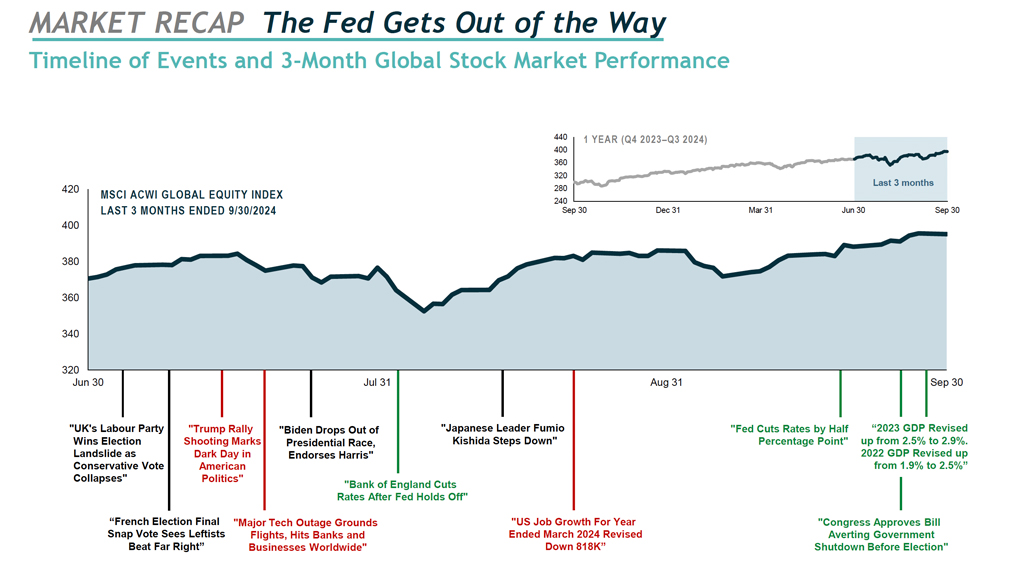

Looking back over the last 90 days of Q3, the Global Equity Index ended higher than when it started, which has been the pattern all year. There were some fluctuations here and there from a variety of events. Two major headlines stood out in interest to Eric when analyzing the market’s overall performance. The first was the UK’s Labor Party winning election, with the Conservative Party being thrown out. Like in the U.S. and around the world, there was inflation in the UK, and the party in power took the blame and got tossed out.

The second headline of particular interest to Eric is that the Federal Reserve cut rates by half a percentage point. While Eric had hoped they’d start cutting rates at the beginning of this year, they’re still catching up. Regardless, we are happy to see a 50 basis point rate cut at the end of the quarter. The market liked that and continues to like that.

Source: BIP Wealth Quarterly Market Report, Q4 2024

Looking at the blended benchmark results, things have continued to evolve since the Fed cut rates. We’re seeing an amazing 5.2% return in the Fixed Income Index for the last 3 months in light of the YTD return being 4.45%.

This is interesting because Interest rates fell across the yield curve. The 3-year return for the Fixed Income Index is -1.39% per year. Now because of the Fed getting out of the way, interest rates have started to rise. We see that as a vote of confidence in the economy. The YTD return as we’re reporting today is less than 2%. More than half of what you see in the YTD return has been wiped out.

It’s a good thing that we do not index our exposure to the fixed income market here at BIP Wealth, instead we’ve been fortunate to take advantage of higher short term rates and have a very stable, predictable return for our clients.

Let’s talk about the future. We’ve been able to be optimistic all year long like we were the year before.

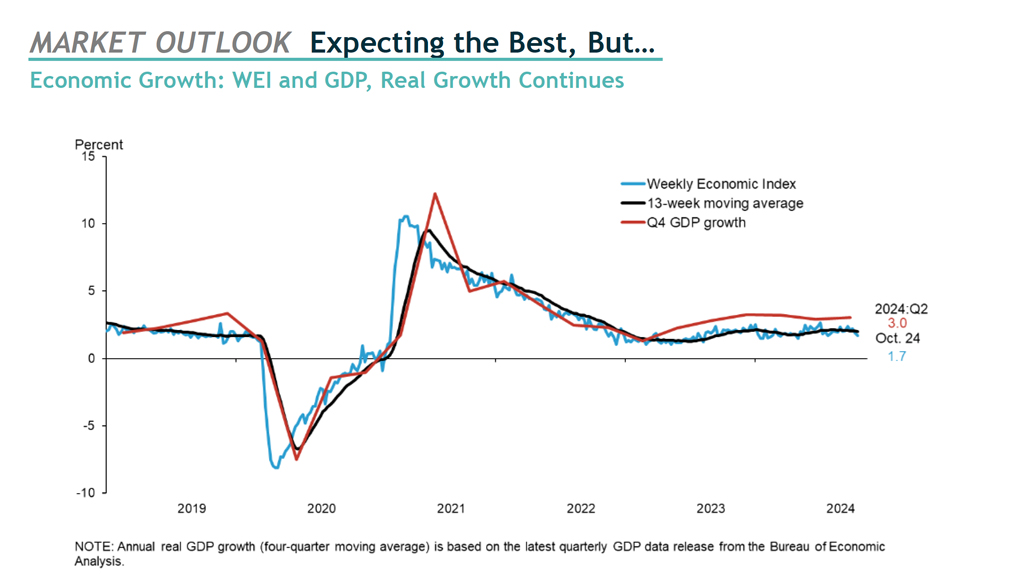

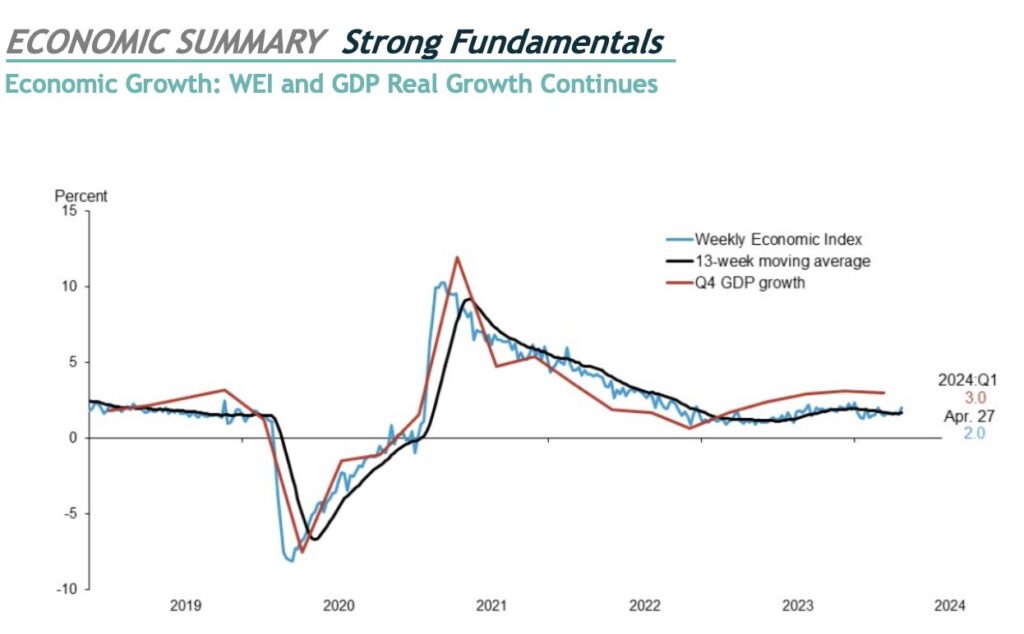

Economic growth has been quite solid. There’s been some interesting updates to prior history that’s come out this quarter. For instance, there was a report that dramatically reduced the number of jobs that have been created in the last 18 months, but just a few days after that, we got an update that revised upwards the 2022 rate of GDP growth and also the 2023 rate of GDP growth.

When we get a GDP number, what we know is that’s not the final number. It will be revised time and time again. Eric’s favorite indicator is the Weekly Economic Index (WEI). It’s a bit more volatile, but over the long run that tends to correlate nicely with the eventual GPD numbers that we’re able to prove valid. What we see with the WEI is that we’re cranking along at about 2% annual real rate of economic growth.

We never saw a reason to predict a recession and we’re not seeing one now. The US economy continues to crank out this nice stable rate of growth.

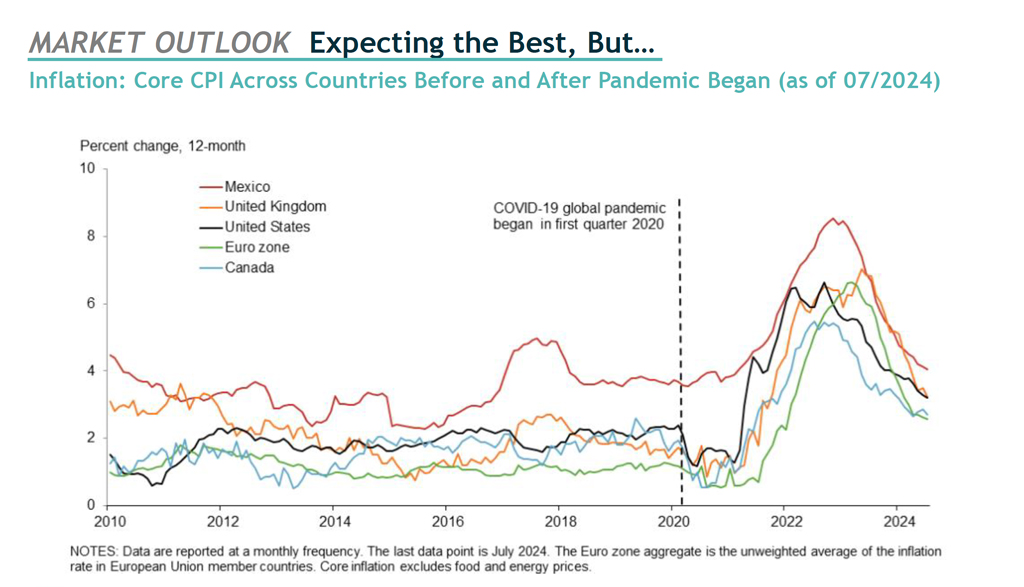

It’s also interesting to look at inflation in many of the major developed economies around the globe. Eric highlighted the below graphic for the first time showing how inflation in these major global economies was bouncing around a bit until the pandemic, and then tended to correlate. Within a year of the pandemic, we see that a couple of major things happened.

One is that all the major central banks followed the lead of the Federal Reserve. The recession only lasted about 3 months in the US from the pandemic because of all the fiscal and monetary stimulus that the government threw at it. Yet the Federal Reserve continued to keep interest rates at essentially zero and all the other central banks followed suit. This became a problem and we saw a knock-on effect as inflation was ignited all over the globe.

What we see now that all these central banks are catching up to the Fed in lowering rates is that inflation is falling. Eric predicts that we’ll continue to see inflation fall and hopefully won’t join the UK where the rate of inflation is too low because deflation can be a real problem.

In conclusion, Eric left clients with some final thoughts. Unlike past years, this year we’re more worried about politics and global conflict than the economy. We’re optimistic about the stock market, but we’re able to enjoy higher returns on safer investments than has been the case in decades, so you don’t have to take risk you don’t need.

The U.S. Presidential Election Has the World on Edge. American election integrity is critical to our democracy and economic prosperity, and we are all waiting to see if the election results, regardless of the outcome, are accepted by the citizenry as legitimate. Policy choices that include taxation, immigration, and civil rights, continue to divide the country. In other words, there will be a lot of unhappy voters no matter what the result. However, historical data suggests that markets have gone up over long periods of time under every administration, regardless of party. American ingenuity and our capitalist system have combined to drive the economy, and our capital markets, forward under almost all political circumstances.

BIP Wealth Has New Tools in the “Toolbox.” Each investment tool, or strategy, is a potential component of a comprehensive investment plan. Each tool has a distinct role to play in an overall investment strategy, and not every tool is needed by every investor. For instance, the BIP Concentrated Stock Strategy seeks to reduce the volatility of a single large stock holding by half, but many investors don’t hold such positions. The BIP Short-Term Tactical takes advantage of the current yield environment to pursue capital preservation while seeking yields meaningfully higher than what most banks are able to offer.

If you’d like to speak to an advisor about your portfolio or want to learn more about how we’re engineered to perform for our clients, be sure to contact us. You can also check out the rest of our resources hub to learn more about the financial market.

Eric has three responses to this:

Yes, that is just South Korea and the rules about listing countries follow a hierarchy. We have developed markets like our own and you have to have property rights and regulation and capitalism functioning more or less the way you’d want it to be with mostly free markets. Then you have a second tier that we call Emerging Markets where some of those things don’t work quite as well. South Korea is certainly a developed market, but then you get other economies that are capitalist and their markets you can invest in and and they’re called Emerging Markets. What we’re showing is the top level developed markets but then also the Emerging Markets, not the frontier and then not the uninvestable markets.

Current tariffs, originating from both the Trump and Biden administrations, can stifle economic growth by disrupting free market dynamics. While some manufacturing has shifted to the U.S. to avoid tariffs, other sectors like textiles have lost jobs overseas, leading to potential inflation and slower global growth. Regarding technology, at BIP Wealth, we advocate for a balanced investment strategy that includes both growth and value stocks, noting that many profitable companies aren’t strictly growth-focused. Additionally, technology’s influence permeates various industries, with advancements like AI benefiting even non-tech sectors. Overall, the relationship between tariffs, technology, and investment is complex and multifaceted.

This communication contains general investing information that is not suitable for everyone and is subject to change without notice. Past performance is no guarantee of future results and there is no guarantee that any views and opinions expressed will come to pass. The information contained herein should not be construed as personalized investment advice, tax advice, or financial planning advice, and should not be considered a solicitation to buy or sell any security. Investing in the stock market and the bond market involves gains and losses and may not be suitable for all investors. Indices are not available for direct investment.

Welcome to another BIP Wealth Quarterly Market Report with Eric Cramer, CFP®, CFA®, Chief Investment Officer. In his Q3 2024 report, Eric walked us through his economic summary from the past few months, including a timeline of major events and the performance of the U.S. Stock Market.

In case you missed the presentation, we’ll go over the main talking points below. You can also watch the recording of Eric’s presentation below.

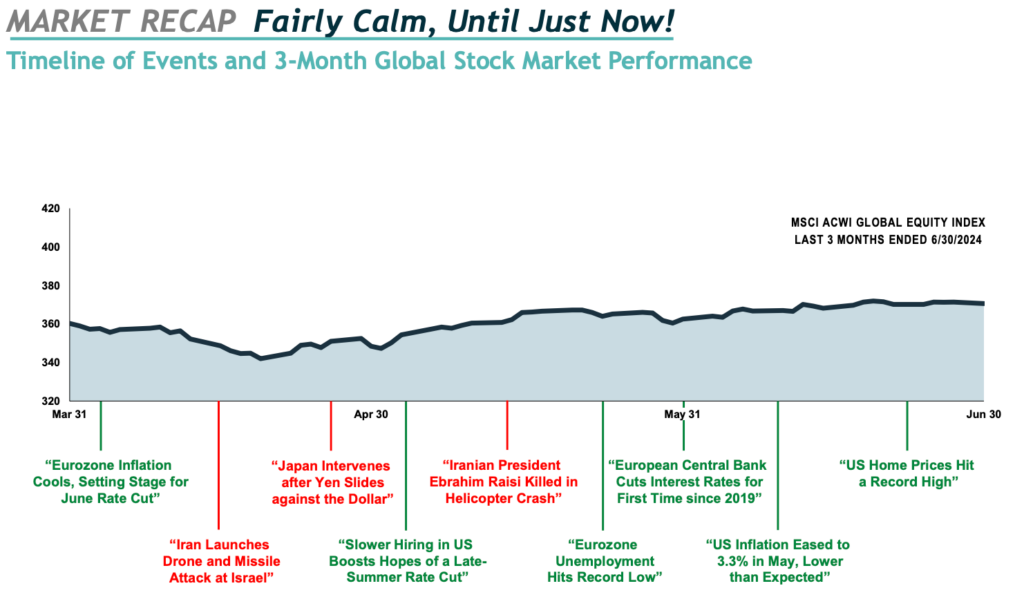

When you look back on the key events that happened in Q2, you’ll notice that the markets remained very calm throughout much of the process. Two major headlines stood out when analyzing the market’s overall performance. The first was Japan intervening against the Yen as it slid relative to the U.S. Dollar. However, this was not “new” news to those in the financial world. We knew this was coming and had a solid plan in place to tackle the market volatility that followed.

The second major headline centered around U.S. hiring rates slowing, boosting hopes of a late-summer rate cut. This was another development we saw coming, as the labor market was overdue for a dip. This is all to say, don’t follow the doomsday headlines too closely. So long as you have a versatile financial plan in place, there are ways to navigate market volatility.

Looking at our blended benchmark results, the Q2 numbers don’t tell the whole story. While the fixed income index is negative, our clients have done substantially better since we don’t take the same risks. Additionally, the global equity index’s YTD performance sits at 10.28%. So, if you thought these numbers were pretty good for being halfway through 2024, they’re even better now as we plow our way through Q3.

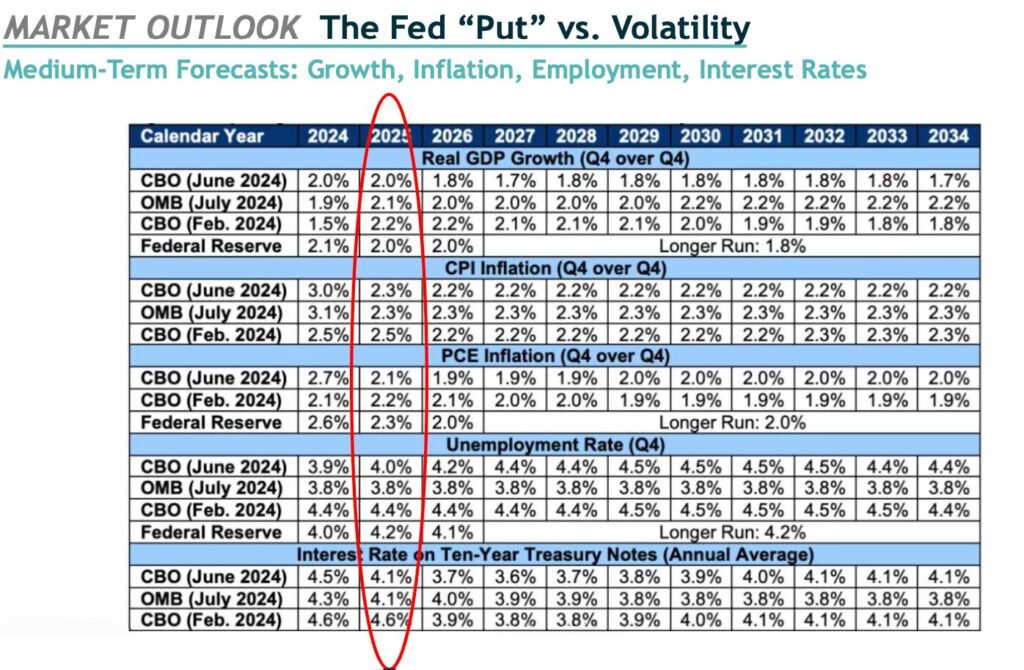

The first thing to look at when discussing Fed “Put” vs. volatility is what we call “Medium-Term Forecasts”. In the report, Eric highlighted the projected 2025 numbers for the most important economic issues, such as real GDP growth (over the rate of inflation) and the unemployment rate. What the numbers show is that nobody is truly predicting an economic recession, even though you may continue to see this in the news headlines.

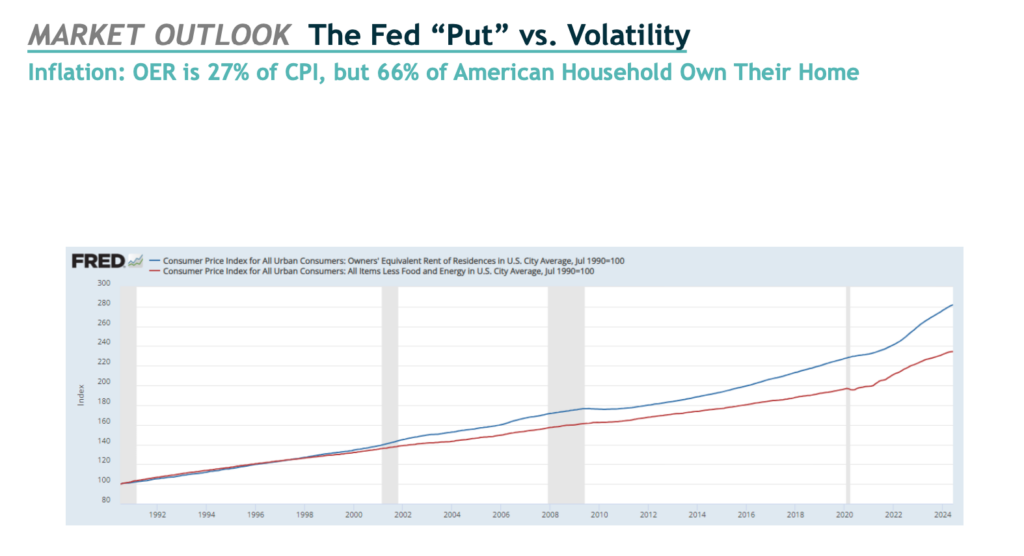

It’s also important to look at inflation in U.S. housing. While many of us have become addicted to reading the latest numbers, Eric discussed why the Consumer Price Index (CPI) rate, as shown in the graph below, is not the best indicator of inflation. This is due, in part, to 66% of American households owning their own home instead of renting. When the value of homes goes up, they are not affected like renters are. As a result, we should not be surprised to see negative CPI numbers in the near future.

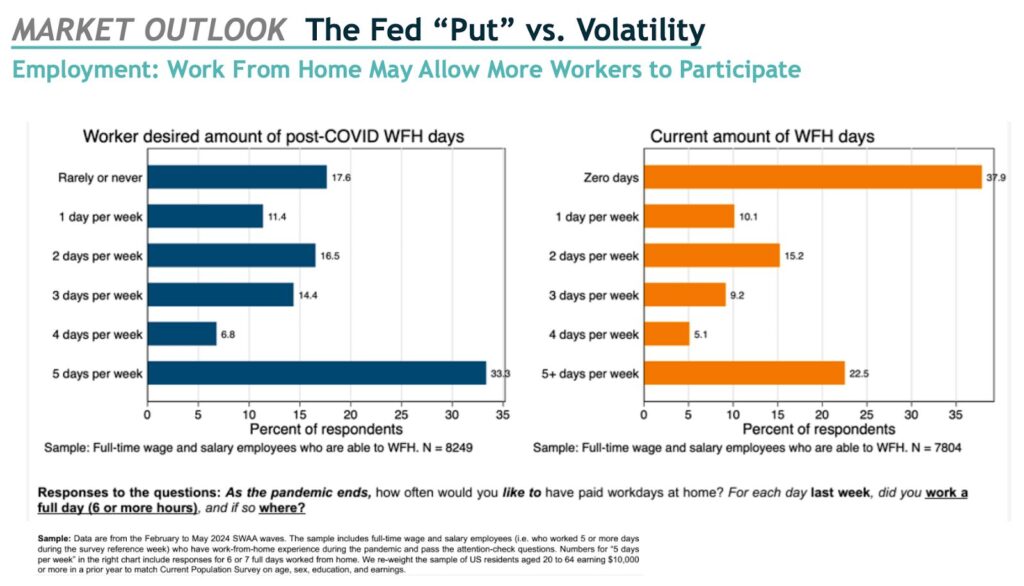

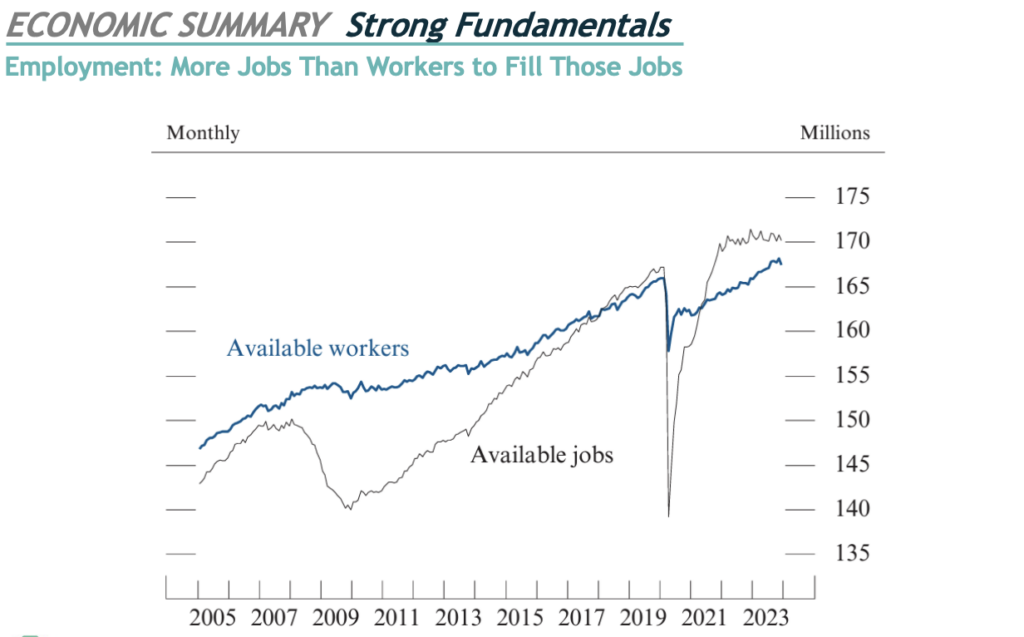

Additionally, the significance of working from home could impact the job market, as it may allow more to participate. Despite what you may hear, we currently have an abundance of open job positions waiting to be filled. And the data shows that companies are offering work-from-home benefits that are very similar to what the current workforce desires. The chart below highlights these numbers further.

Before signing off, Eric left our clients with his three biggest talking points for Q3. The first is that our economy is fundamentally strong. Every broad measure of our economy is healthy at the moment, although there are specific issues such as inflation in housing that are affecting some. The second is that we will survive the upcoming election in Q4. It’s easy for certain individuals such as economic analysts to mislead their audience with a political agenda. Remember that if you’re only looking at one news source, you’re only getting one side of the story. Always be on the lookout for the truth. Finally, BIP continues to add new tools to the toolbox. The BIP Short-Term Tactical, for example, takes advantage of the current yield environment to pursue capital preservation while seeking yields meaningfully higher than what most banks can offer.

If you’d like to speak to an advisor about your portfolio or want to learn more about how we’re engineered to perform for our clients, be sure to contact us. You can also check out the rest of our resources hub to learn more about the financial market.

BIP Wealth invests in private equity differently than the industry. We have direct access to private market opportunities through our venture capital firm, BIP Capital. We have a rigorous investment committee process where we vet various private equity opportunities, that are in it for consistency. We have a different approach from standard private equity investing and use financial planning software to perform a thorough analysis of each client’s financial situation, so we’re not taking uncompensated risks.

BIP Wealth has models in our financial planning process that can provide baseline recommendations of allocations for private equity investments. However, it all depends on your personal circumstances. We make adjustments for different factors including life expectancy, liquidity needs, and your understanding of the market and how it works.

This communication contains general investing information that is not suitable for everyone and is subject to change without notice. Past performance is no guarantee of future results and there is no guarantee that any views and opinions expressed will come to pass. The information contained herein should not be construed as personalized investment advice, tax advice, or financial planning advice, and should not be considered a solicitation to buy or sell any security. Investing in the stock market and the bond market involves gains and losses and may not be suitable for all investors. Indices are not available for direct investment.

Author: Eric Cramer, CFP®, CPA®

Welcome to our recap of the 2024 Q2 Market Report. Eric Cramer, Chief Investment Officer at BIP Wealth, walked our clients through the current state of the U.S. economy and laid out his key takeaways from the second quarter of 2024.

In case you missed the presentation, we’ll break down the major talking points below, including the strong fundamentals we’re seeing and artificial intelligence’s role in combating inflation. You can also watch the recorded version of Cramer’s Q2 QMR by clicking the link below.

Regardless of some of the headlines we’ve seen recently, the U.S. market saw one of its smoothest quarters ever in Q2, according to Cramer. While there were individual stocks that had a rough quarter, a diversified portfolio more than likely enjoyed a smooth, consistent ride upwards. This is highlighted by the U.S. stock market finishing the first quarter up a little over 10%. Now, why is this? For Cramer, it all boils down to the strong fundamentals we’re continuing to see in the U.S. economy.

Unsurprisingly, growth stock led the charge for Q2’s market growth. However, the big news for Cramer is the continued rise in the U.S.’s share of the global stock market. With a current share of $50.7 trillion, the U.S. now controls 63% of the World Market Capitalization. This represents a 4% increase from just one year ago.

Another strong indicator of our current market health is the rate of available workers to available jobs. In 2020, for example, we saw a dramatic loss of available jobs due to the pandemic. Today, however, the number of available workers is outpacing the number of available jobs, which is great news. For Cramer, it is the backbone of his belief that we are not close to a recession anytime soon.

You may not have heard too much about this one, but we’re seeing unemployment rates among the major demographic groups in the U.S. collectively fall. This is a trend you see during a strong economic surge, regardless of who may be in control in Washington. For Cramer, the differences in the unemployment rates are about as small as he’s ever seen them. So, the rising tides have lifted all boats, if Q2 had anything to say about it.

A common piece of data that economists will use to showcase the strength of the economy is GDP. For Cramer, though, the numbers in the Weekly Economic Index are just as important. What we’re seeing is that the WEI rate is settling into a 2% rate of growth. This is considered real growth, over and above the rate of inflation. This rate is very healthy, and it could even see an uptick in the near future.

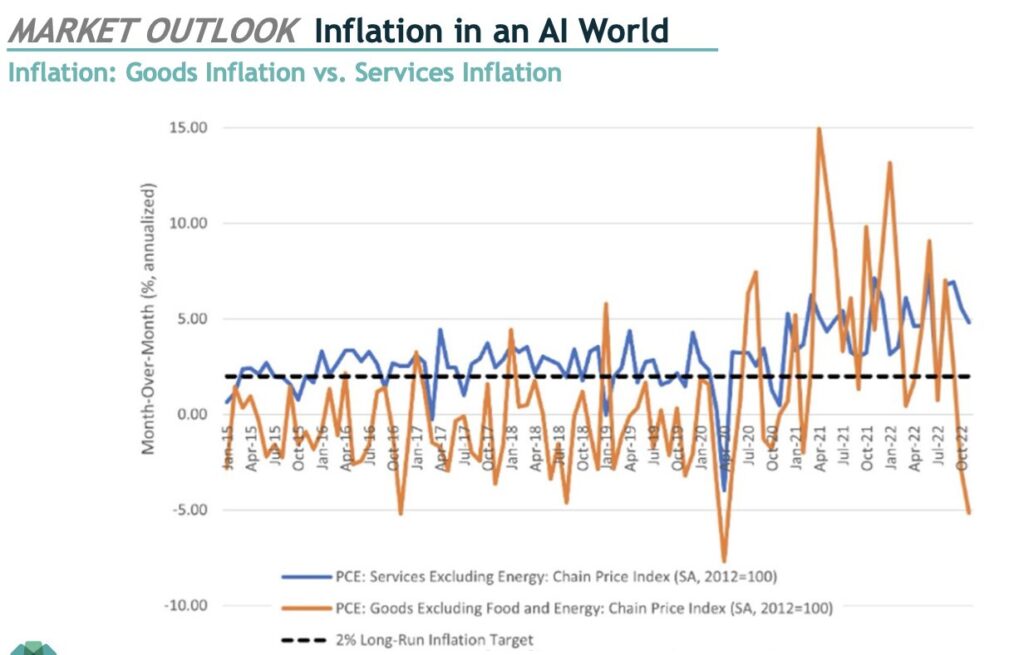

Most of us experience inflation through commodities. You may go to the gas pump and have to pay more than you did the previous visit. You may find yourself seeing higher prices on groceries. Whatever your experience may be, many of us feel the volatility of commodities through these sorts of experiences. This does not paint the entire picture of inflation, however. There is also inflation with services. When we buy things today, we’re very likely to be paying for services as often as we are goods. The chart below demonstrates how as the prices for goods have fallen, the prices for services have gone up.

So, how might artificial intelligence play a role in this world of inflation? For Cramer, there are some similarities and lessons from the past to watch out for. According to a 2023 report from Goldman Sachs, it is estimated that AI could replace 300 million jobs while increasing the GDP by 7% over the next 10 years. As a result, we could see the prices for services decrease as AI’s role in industries such as healthcare, education, and others continues to grow. This is not to say we will need significantly fewer humans in the workforce, but similar to inventions like steam engines and the Internet, AI could help us grow markets through innovation and efficiency, which could lead to deflation.

Before signing off, Cramer left us with four key takeaways from the presentation. These ranged from the rise of AI to the overall themes of 2024:

When examining your financial plan with your BIP Wealth advisor, you may discuss the current political and geopolitical conflicts.

This is easy to miss in an election year. However, our team believes that every broad measure of our economy is healthy as it currently stands.

Don’t shy away from this, though. Instead, embrace what the future of artificial intelligence may hold for financial markets.

From opportunities in public and private markets to BIP’s hedged equity investments, our advisors are hard at work to ensure our clients maintain a diversified portfolio to combat volatility.

If you’d like to speak to an advisor about your portfolio or want to learn more about how we’re engineered to perform for our clients, be sure to contact us. You can also check out the rest of our resources hub to learn more about the financial market.

This communication contains general investing information that is not suitable for everyone and is subject to change without notice. Past performance is no guarantee of future results and there is no guarantee that any views and opinions expressed will come to pass. The information contained herein should not be construed as personalized investment advice, tax advice, or financial planning advice, and should not be considered a solicitation to buy or sell any security. Investing in the stock market and the bond market involves gains and losses and may not be suitable for all investors. Indices are not available for direct investment.

This quarter’s theme is, “How to Prepare for Market Disruptions.” Listen in as BIP Wealth’s Chief Investment Officer, Eric Cramer, covers what’s going on in the financial markets and how we’re advising our clients.