Welcome to our final BIP Wealth Quarterly Market Report of 2024 with Eric Cramer, CFP®, CFA®, Chief Investment Officer. In Q4’s report leading up to the 2024 U.S. Presidential Election, Eric starts with a look at historical trends under each presidential administration dating back to 1926 and touches on other key economic data points.

In case you missed the presentation, we’ll go over Eric’s main talking points below. You can also watch the recording of the presentation below.

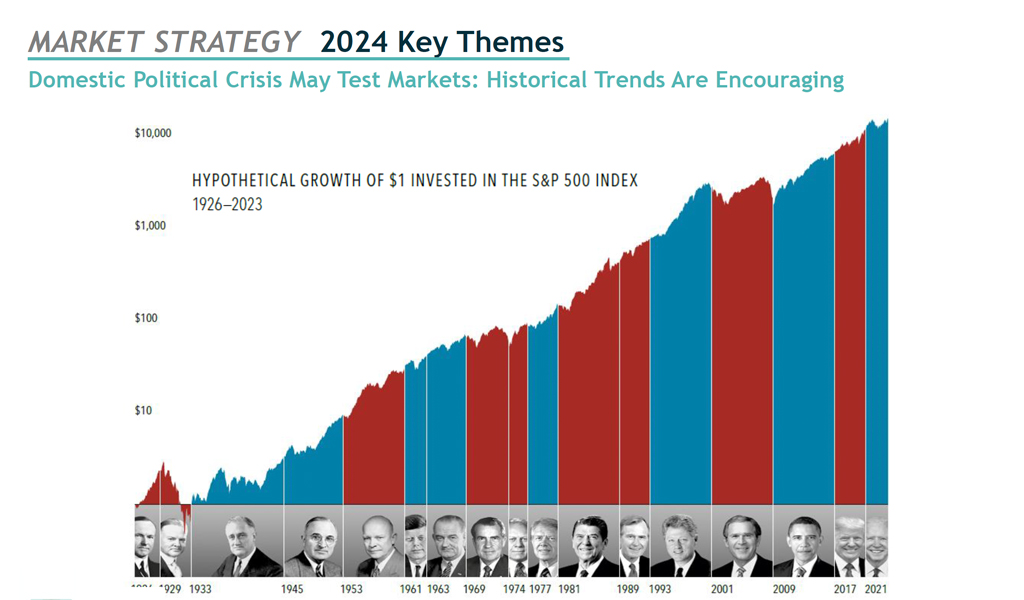

Historical Trends Are Encouraging

With the upcoming 2024 U.S. Presidential Election, we know that a political crisis may test the market. Eric encouraged everyone to take a moment to put on their investor hat. From that more narrow perspective, Eric reviewed the history of the S&P 500 to see how that’s performed over history in the context of who is in the White House. What we see is that markets have gone up over long periods of time under every administration. The point is to remind people that when you’re investing in the stock market, you’re really investing in a much larger system than who is in office at any particular time. You’re investing in democracy, you’re investing in capitalism, you’re investing in the ingenuity and entrepreneurialism of the U.S. in particular. It’s an investment and trust in a system that’s bigger than any one particular candidate.

Source: BIP Wealth Quarterly Market Report, Q4 2024

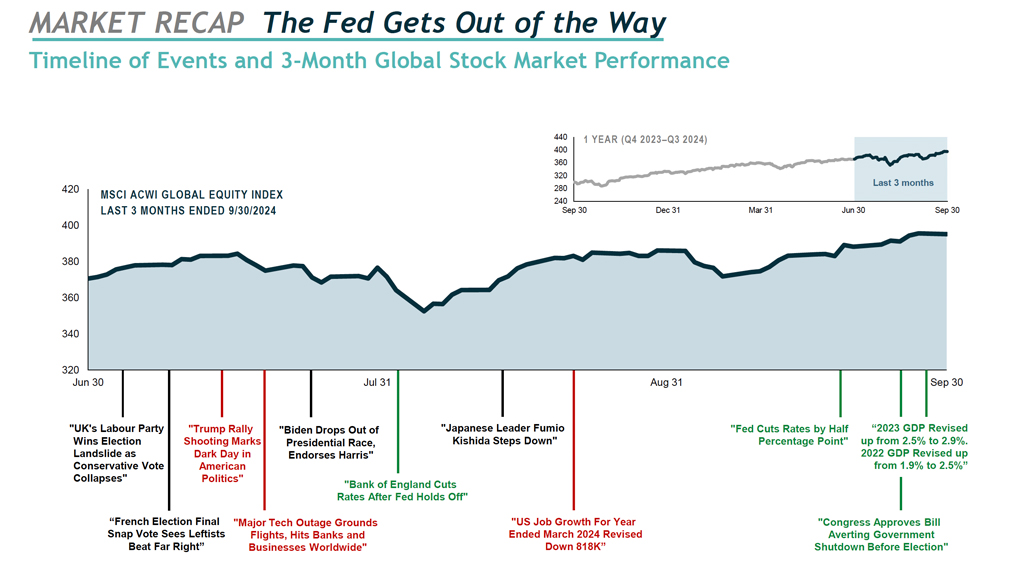

The Recap: The Fed Gets Out of the Way

Looking back over the last 90 days of Q3, the Global Equity Index ended higher than when it started, which has been the pattern all year. There were some fluctuations here and there from a variety of events. Two major headlines stood out in interest to Eric when analyzing the market’s overall performance. The first was the UK’s Labor Party winning election, with the Conservative Party being thrown out. Like in the U.S. and around the world, there was inflation in the UK, and the party in power took the blame and got tossed out.

The second headline of particular interest to Eric is that the Federal Reserve cut rates by half a percentage point. While Eric had hoped they’d start cutting rates at the beginning of this year, they’re still catching up. Regardless, we are happy to see a 50 basis point rate cut at the end of the quarter. The market liked that and continues to like that.

Source: BIP Wealth Quarterly Market Report, Q4 2024

Looking at the blended benchmark results, things have continued to evolve since the Fed cut rates. We’re seeing an amazing 5.2% return in the Fixed Income Index for the last 3 months in light of the YTD return being 4.45%.

This is interesting because Interest rates fell across the yield curve. The 3-year return for the Fixed Income Index is -1.39% per year. Now because of the Fed getting out of the way, interest rates have started to rise. We see that as a vote of confidence in the economy. The YTD return as we’re reporting today is less than 2%. More than half of what you see in the YTD return has been wiped out.

It’s a good thing that we do not index our exposure to the fixed income market here at BIP Wealth, instead we’ve been fortunate to take advantage of higher short term rates and have a very stable, predictable return for our clients.

The Market Outlook: Expecting the Best, But…

Let’s talk about the future. We’ve been able to be optimistic all year long like we were the year before.

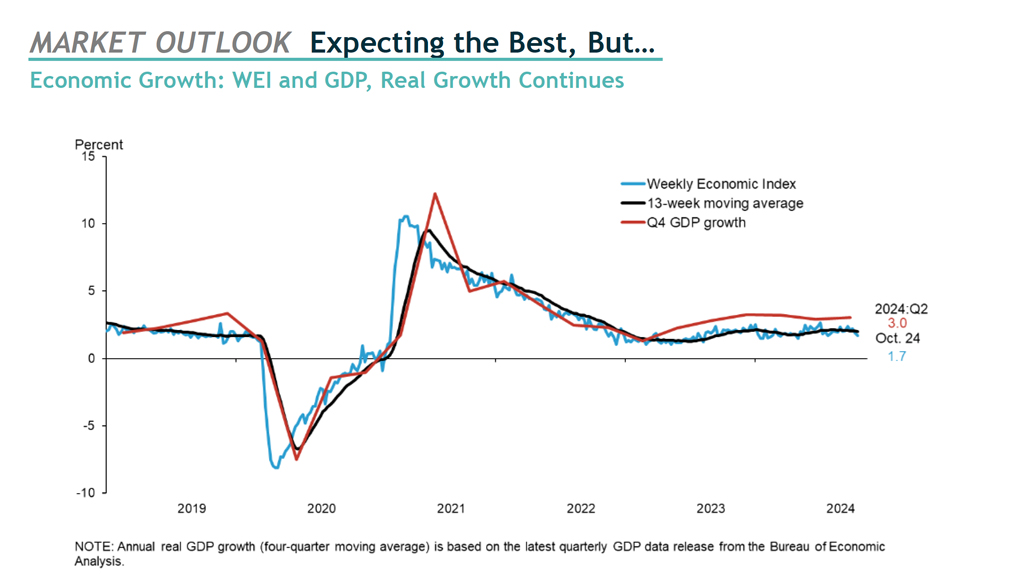

Economic growth has been quite solid. There’s been some interesting updates to prior history that’s come out this quarter. For instance, there was a report that dramatically reduced the number of jobs that have been created in the last 18 months, but just a few days after that, we got an update that revised upwards the 2022 rate of GDP growth and also the 2023 rate of GDP growth.

When we get a GDP number, what we know is that’s not the final number. It will be revised time and time again. Eric’s favorite indicator is the Weekly Economic Index (WEI). It’s a bit more volatile, but over the long run that tends to correlate nicely with the eventual GPD numbers that we’re able to prove valid. What we see with the WEI is that we’re cranking along at about 2% annual real rate of economic growth.

We never saw a reason to predict a recession and we’re not seeing one now. The US economy continues to crank out this nice stable rate of growth.

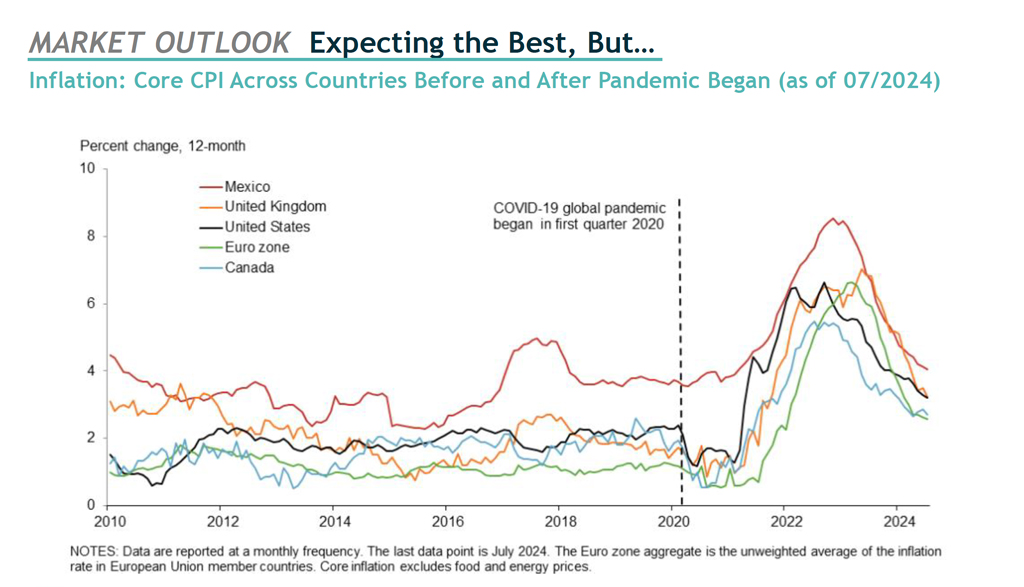

It’s also interesting to look at inflation in many of the major developed economies around the globe. Eric highlighted the below graphic for the first time showing how inflation in these major global economies was bouncing around a bit until the pandemic, and then tended to correlate. Within a year of the pandemic, we see that a couple of major things happened.

One is that all the major central banks followed the lead of the Federal Reserve. The recession only lasted about 3 months in the US from the pandemic because of all the fiscal and monetary stimulus that the government threw at it. Yet the Federal Reserve continued to keep interest rates at essentially zero and all the other central banks followed suit. This became a problem and we saw a knock-on effect as inflation was ignited all over the globe.

What we see now that all these central banks are catching up to the Fed in lowering rates is that inflation is falling. Eric predicts that we’ll continue to see inflation fall and hopefully won’t join the UK where the rate of inflation is too low because deflation can be a real problem.

The Final Thoughts

In conclusion, Eric left clients with some final thoughts. Unlike past years, this year we’re more worried about politics and global conflict than the economy. We’re optimistic about the stock market, but we’re able to enjoy higher returns on safer investments than has been the case in decades, so you don’t have to take risk you don’t need.

The U.S. Presidential Election Has the World on Edge. American election integrity is critical to our democracy and economic prosperity, and we are all waiting to see if the election results, regardless of the outcome, are accepted by the citizenry as legitimate. Policy choices that include taxation, immigration, and civil rights, continue to divide the country. In other words, there will be a lot of unhappy voters no matter what the result. However, historical data suggests that markets have gone up over long periods of time under every administration, regardless of party. American ingenuity and our capitalist system have combined to drive the economy, and our capital markets, forward under almost all political circumstances.

BIP Wealth Has New Tools in the “Toolbox.” Each investment tool, or strategy, is a potential component of a comprehensive investment plan. Each tool has a distinct role to play in an overall investment strategy, and not every tool is needed by every investor. For instance, the BIP Concentrated Stock Strategy seeks to reduce the volatility of a single large stock holding by half, but many investors don’t hold such positions. The BIP Short-Term Tactical takes advantage of the current yield environment to pursue capital preservation while seeking yields meaningfully higher than what most banks are able to offer.

If you’d like to speak to an advisor about your portfolio or want to learn more about how we’re engineered to perform for our clients, be sure to contact us. You can also check out the rest of our resources hub to learn more about the financial market.

Questions Asked:

- Despite the Fed lowering interest rates by 50 basis points, treasury rates specifically those for longer term treasuries have gone up substantially. Is this a concerning trend predicting a near-term recession or issues with our national debt?

Eric has three responses to this:

- Investment Style: BIP Wealth’s fixed income investment approach minimizes risk, leading to better portfolio performance compared to past index declines.

- Short-Term Interest Rates: Eric likens the Fed’s management of short-term interest rates to balancing a broom, where changes in rates can inversely affect the economy and long-term rates.

- National Debt Concerns: While excessive government borrowing could lead to rising long-term interest rates (crowding out theory), Eric believes the current situation is manageable. Lowering short-term rates could stimulate economic growth, leading to a healthier yield curve, which is typically characterized by low short-term rates and higher long-term rates. Overall, this scenario is seen as a positive development for the economy.

- On the First Market recap slide there was a reference to Korea and was that in particular just South Korea?

Yes, that is just South Korea and the rules about listing countries follow a hierarchy. We have developed markets like our own and you have to have property rights and regulation and capitalism functioning more or less the way you’d want it to be with mostly free markets. Then you have a second tier that we call Emerging Markets where some of those things don’t work quite as well. South Korea is certainly a developed market, but then you get other economies that are capitalist and their markets you can invest in and and they’re called Emerging Markets. What we’re showing is the top level developed markets but then also the Emerging Markets, not the frontier and then not the uninvestable markets.

- What if any changes to our investment philosophy do you foresee if a significant tariff regime is implemented by a new Administration?

Current tariffs, originating from both the Trump and Biden administrations, can stifle economic growth by disrupting free market dynamics. While some manufacturing has shifted to the U.S. to avoid tariffs, other sectors like textiles have lost jobs overseas, leading to potential inflation and slower global growth. Regarding technology, at BIP Wealth, we advocate for a balanced investment strategy that includes both growth and value stocks, noting that many profitable companies aren’t strictly growth-focused. Additionally, technology’s influence permeates various industries, with advancements like AI benefiting even non-tech sectors. Overall, the relationship between tariffs, technology, and investment is complex and multifaceted.

This communication contains general investing information that is not suitable for everyone and is subject to change without notice. Past performance is no guarantee of future results and there is no guarantee that any views and opinions expressed will come to pass. The information contained herein should not be construed as personalized investment advice, tax advice, or financial planning advice, and should not be considered a solicitation to buy or sell any security. Investing in the stock market and the bond market involves gains and losses and may not be suitable for all investors. Indices are not available for direct investment.