Are you an investor? Are you looking to start investing? Creating a holistic financial plan can be daunting for investors, especially those who may be new to the industry. Objectives and markets can change in a heartbeat, making holistic financial management and investment planning a crucial part of any successful portfolio. So, what directions can investors go in? What should they know?

In this guide, we’ll discuss everything from Roth IRA strategies to the differences between investment management vs. asset management. Let’s start by first analyzing your current financial plan and why it may be dangerous in today’s markets.

No two financial plans are created equal. While your main goals might look similar to someone else’s, their investment strategy may not fit your unique financial situation. There are five main aspects to consider when first analyzing your financial management, and it all starts with planning—or struggling to plan—for the future.

Rewind five or ten years. Did you know then what you would be making today? And that can include your salary, investment returns, or any other form of income. An issue some investors may run into is that their current financial management assumes that they will continue to make a healthy amount of money. If your income suddenly slashes, it could seriously impact your retirement. So, to counteract this, it is important to establish what your “worst-case” scenario is. This can help you and your financial advisor create multiple plans of action to solidify your retirement goals.

When you first began investing, did you consider the outside costs that come with owning assets such as stocks? This is another mistake that is easy for new investors to make when considering their financial management strategies. For example, you could end up paying 2% or more in total investment expenses if your plan assumes that there are zero investment expenses out there.

Do you make this common financial management mistake? Your stock portfolio gained 20% in the previous fiscal year and you decide to sell most of it off at reposition. With a 4-5% tax hit, that 20% will look more like 15% when it is all said and done. Short-term gains are taxed at a higher rate, so it is important to consider the financial impacts of taxes before you decide to sell a large chunk of your investment portfolio.

For older investors, social security could be a great way to have a fantastic retirement. You paid your dues and now have the chance to be financially comfortable after you finish working. A lot of others, however, may not get this luxury. According to the 2023 Annual Report, the program may exhaust itself by 2033, meaning benefits may take a massive hit. For younger investors, it is important to plan for retirement without the traditional social security benefits we’ve known.

The final mistake investors make, by no true fault of their own, is not dying on schedule. The best financial management and investment strategies may plan for a life expectancy that you only have a 10% chance of achieving to account for the possibility of a longer life.

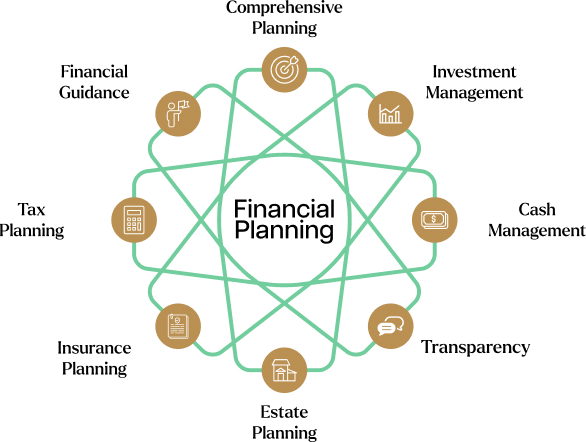

Now that we’ve identified some of the common pitfalls investors may face when building their investment strategies, let’s take a look at the core pillars of financial management. It all starts with establishing what the right plan is for your personal goals.

There are several ways you can manage your financial and investment strategies in today’s market. Two of these include investment management and asset management. So, which one is right for you? The answer depends on your ultimate investing goals.

Versus asset management, investment management involves handling financial assets and investments, going beyond mere stock trading to encompass budgeting, tax strategies, and more. It’s about strategically managing a portfolio to meet specific wealth accumulation goals through informed buying, selling, and holding based on market research and economic analysis. Pros include tailored strategies and active management.

Asset management, often used interchangeably with investment management, extends beyond securities to encompass real estate, commodities, and other assets. It focuses on understanding an investor’s goals for long-term capital growth, rather than short-term stock market gains. Asset management provides a holistic financial management experience, considering a wider array of holdings and needs.

If you’re looking to grow your wealth through financial management that encompasses primarily stocks and bonds, you may lean more on the side of investment management vs. asset management. However, if you already own many valuable assets such as homes, cars, and investments, asset management may be the way to go. If you’d like to talk with a trusted BIP Wealth advisor to learn more about these two strategies, please contact us.

Once you’ve identified whether you prefer investment management or asset management, it’s important also to consider the pros and cons of portfolio management and wealth management. These two strategies give investors two different paths for growing their wealth over time.

Compared to wealth management, portfolio management involves crafting a tailored financial plan considering risk and reward, aiming for high returns while managing overall risk. There are four types: active, passive, discretionary, and non-discretionary. Active management seeks to beat market benchmarks, while passive aims to match them. Discretionary managers make decisions independently, while non-discretionary managers require client input.

Wealth management, however, is a much more holistic financial management plan. This approach offers a broader spectrum of services compared to portfolio management, aiming to tailor strategies to clients’ diverse needs and long-term goals. It encompasses investment strategies, retirement planning, and more, ensuring holistic wealth growth and protection. Core elements include financial planning, asset allocation, asset management, estate, and tax planning.

Maintaining an investment strategy that can provide the best risk versus return is something that is always on the minds of investors today. So, how do Roth IRA strategies come into play? To start, they can help investors minimize the amount of tax drag, resulting in increased tax alpha. Effective Roth IRA strategies, if managed correctly, can potentially eliminate taxes. Since 1998, legislative changes have increasingly favored affluent investors in utilizing Roth IRAs. Investment managers can capitalize on these changes to enhance tax alpha for clients, often in collaboration with tax advisors. These strategies are generally low-risk and are welcomed by tax advisors aiming to minimize clients’ tax burdens.

To boost your Roth IRA strategies, the most basic technique is increasing the amount of money you put into it. As of 2024, the contribution limits are $7,000, with an additional $1,000 for folks over the age of 50.

Now that we’ve covered the basic aspects of financial management, let’s shift our focus to how to shape your investment strategies.

Defining what you want to accomplish through financial management is a critical first step to building a successful strategy. Do you have any existing assets you’d like to include in your financial management strategy? Are you looking for short-term gains? Long-term? These are just a few of the questions you should consider as you plan with your financial advisor as they help you get a clearer picture of your current and desired financial wealth status.

Once you’ve established your plan and set your overall goals, the next step is to figure out what you can and can’t afford to include in your financial management strategy. Budgeting helps you understand your income and expenses, giving you a clear picture of your financial situation. Budgeting for your investment strategy can also help you free up funds that can be directed towards investments, whether it’s in stocks, real estate, or retirement accounts.

Investing is not guaranteed to succeed. As a result, it is important to understand where you stand regarding risk. How much could you afford to lose if a stock price suddenly dips? Is your portfolio diversified to handle the rise and fall of stock prices? Managing risk can help investors maintain financial stability, both in the short and long term.

With the above information in mind, now it’s time to implement your investment strategy. There are a few critical steps to follow, the first being to have a critical eye when identifying your desired path forward.

To use a sports analogy, let’s think of your financial management strategy as a game of football. As the head coach of your wealth growth, it is important to think strategically about every move you make to ensure it aligns with your ultimate goals. At BIP Wealth, our advisors focus on factors such as investments, risk, and changing markets to quarterback your portfolio to success and act as your personal CFO.

We mentioned earlier in this guide that Roth IRA strategies can be the “holy grail” of tax-smart investing. By diversifying your investment strategy portfolio with retirement in mind, you can help establish long-term financial success for you and your loved ones.

Once you’ve nailed down your strategy, it is important to ensure your financial management strategy is robust and versatile. Set short and long-term goals for yourself, be specific in your objectives, and always account for taxes and inflation, as the two can dramatically affect your investment strategies at any time.

Keeping track of your financial management can be tricky. There are ways to streamline this process, however. At BIP Wealth, our proprietary platform—BIP ClientCare—helps clients manage and monitor your wealth. Talk to your advisor about how this tech platform can be utilized to help you.

At BIP Wealth, our trusted team of advisors helps clients achieve long-term financial success through holistic wealth planning that puts your personal goals and needs at the top. To learn more about our story and how we’re engineered to perform for you, be sure to get in touch with an advisor today. You can also check out our news and blog section to learn more about the headlines dominating the financial world today.

The main goal of financial management is to maximize the value of an organization or individual’s financial resources while mitigating risk.

Financial management, when done right, can help investors and organizations effectively manage their resources, make informed financial decisions, and plan for their financial future.

Financial strategies could include portfolio and wealth management, Roth IRA strategies, and even investment and asset management.

While answers will depend on your personal goals and financial situation, it’s good practice to budget for and track your investments over time.

Start by setting your goals and planning out a budget. From there, it’s all about creating the right investment strategy that sets you up for short and long-term success.

This communication contains general investing information that is not suitable for everyone and is subject to change without notice. Past performance is no guarantee of future results and there is no guarantee that any views and opinions expressed will come to pass. The information contained herein should not be construed as personalized investment advice, tax advice, or financial planning advice, and should not be considered a solicitation to buy or sell any security. Investing in the stock market and the bond market involves gains and losses and may not be suitable for all investors. Indices are not available for direct investment.