BIP Wealth, recently named on wealthmanagement.com’s RIA Edge 100, as well as the top 3 on the Atlanta Business Chronicle’s 2023 Best Places to Work list for medium-sized companies, is proud to welcome the addition of former MLB outfielder Jeremy Hermida to its Baseball Division as Business Development Officer. Hermida joins former Pro Baseball players Kyle Schimdt, CFP®; John Hester, CFP®; and Chase Murray in the Baseball Division founded by former Major League Baseball pitcher Jim Poole.

Hermida was the Marlins’ No. 1 draft pick (11th overall) in the 2002 Major League Baseball draft and one of the highest-rated minor league players throughout his 3-year ascent to the MLB. He went on to play professionally for 14 years, 6 of which were in the majors for the Florida Marlins, Boston Red Sox, Oakland Athletics, Cincinnati Reds, and San Diego Padres. He ended his professional playing career in 2015 in Japan with the Hokkaido Nippon Ham Fighters.

Having Jim Poole as one of his personal and professional mentors for 7+ years, Hermida knew he wanted to be more involved with the Baseball Division at BIP Wealth. With his deep admiration and firsthand knowledge of the importance of having exquisite financial advice and guidance, it was an easy ‘yes’ for Hermida to move from being a client of BIP to joining the team. He considers his current role both an honor and a calling.

BIP Wealth’s Baseball Division provides investment management and sophisticated planning solutions geared towards the goals and objectives of draft-eligible, current, and retired professional baseball players and their families. Hermida is uniquely positioned to help guide clients through their journey of life on and off the field.

“BIP is in a class of its own when it comes to client care and expertise, and I am thrilled to be a part of the team,” said Hermida. “Being mentored by Jim Poole helped lead me to where I am today on the team. I started with a few private investment deals as a hobby and became more and more interested after my playing days. I’m so ready for this second career and the chance to take a more hands-on approach to guiding current and former players and their families as they prepare for the future.”

“Jeremy has been a part of the BIP Wealth family for the past 7 years as a client. We’re excited that he’s decided to take this next step in his post-playing life by joining our Baseball Division,” shared Bill Harris, CFP®, Co-Founder & CEO of BIP Wealth. “Jeremy has played baseball all over the world, so he knows first-hand the ups and downs of a professional career. His extensive playing experience and financial aptitude will be a strong addition to our team. The future success of BIP Wealth’s Baseball Divison just took a big step forward.”

Hermida lives in the Dunwoody area with his wife of 12 years, Lindsey, and their son and two daughters. Born and raised in Marietta, Hermida went and married a northern Jersey girl, so you can find them splitting their summer vacations between the south and the north.

Contact Jeremy: Jeremy Hermida, BIP Wealth Baseball Division, Business Development Officer

Press Contact: Jenni Brown, Chief Marketing Officer

###

So, what does 43 days mean for current and retired baseball pros? It is the total number of service days required to qualify for the MLB Pension Plan. The Major League Baseball Player’s Association battled hard to get it in place, so in this blog, we’ll be explaining why it’s important for players to take full advantage.

When the time comes for a player to retire from professional baseball, having access to a share of the MLB Pension Plan can go a long way, especially for those whose careers may have been cut short due to injury. So, what exactly is the MLB Pension Plan? How does it benefit players? And how can a partner like BIP Wealth help baseball players secure their financial future?

The MLB Pension Plan is a type of employer-sponsored retirement plan, also known as a defined benefit plan. These types of plans provide retired professionals with a monthly payment based on a certain formula.

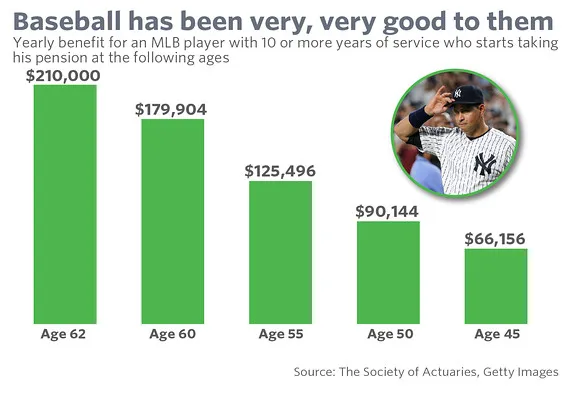

The MLB Pension Plan can be “turned on” as early as age 45, but by waiting until age 62, players would maximize their potential payouts. After hitting 43 days of service, which is defined as days spent on an active MLB roster or injured list, a player qualifies for 2.5% of the max payout. Every additional 43 days will accrue another 2.5% and so on until a player hits 10 years of service, which would qualify them for the max payout.

Currently, the average monthly MLB Pension Plan payout sits at around $7,500 per month, but those who wait until age 62 could top out at around $265,000 per year.

For young and active ballplayers, we recommend focusing on having the most successful and sustainable career possible, as this will directly impact your MLB Pension Plan qualifications. A partner like BIP Wealth will help you navigate the intricacies of your pension plan to better set you up for a successful financial future.

Once you enter your retirement years, our team will work to maximize your accumulated benefits and consider other savings methods, such as IRAs, Roth IRAs, and 401k plans.

The upside of having an MLB pension plan goes further than just the obvious benefit of players receiving a guaranteed monthly payment. The money players receive lasts for life, giving them a consistent income to lean into as they enjoy retirement or search for new career opportunities. There is a cost-of-living adjustment with MLB Pension Plans, so payments will increase over time based on inflation.

A retirement plan for MLB players can also give them a sense of financial security for their later years off the playing field. Savings, unlike funds from a pension plan, can easily be spent before retirement, which has led to an unfortunate 78% of former professional athletes going broke within three years of retirement.

On top of all of this, there are also spousal benefits that can be earned through the MLB Pension Plan. This can significantly help beneficiaries achieve the peace of mind that they and their families will be taken care of for life.

At BIP Wealth, we want to make sure every professional baseball player we take on as a client maximizes their financial potential. To do this, we not only help them through their MLB Pension Plan process but also create unique, life-long financial plans that fit the needs of themselves and their families.

As former professional baseball players, our financial advisors have a unique insight into the MLB Pension Plan and how to best plan for what comes after their playing days. This allows us to provide a perspective that most other wealth managers can’t. We’ve been in a player’s shoes, and we can relate to a player’s financial needs and worries.

To learn more about our services and how you can maximize your career earnings, contact us to speak with one of our advisors. You can also schedule a time to talk with us on the phone or at one of our locations in Buckhead, Alpharetta, and Columbus GA, as well as Nashville, TN.

How much do MLB players get for pension?

Major League Baseball players receive 2.5% of their max monthly pension plan payout, currently up to $265,000 per year, for every 43 days of active service.

How much is a 10-year MLB pension?

Once a player officially hits 10 years of service, they are eligible for up to $265,000 per year if they wait until age 62 to activate their pension plan.

How much is MLB’s pension per year?

The number varies depending on a player’s number of active service days. At the current max payout, a player would receive $3.18 million per year.

What is your experience and expertise in working with professional athletes, particularly professional baseball players?

At BIP Wealth, our Baseball Division advisors have all been professional baseball players, allowing us to provide clients with a unique perspective that is hard to find anywhere else in the industry.

How can you help professional baseball players optimize their taxes and make the most of their earnings during their playing careers and beyond?

Beyond maximizing their MLB Pension Plans, we take the time to understand a player’s unique financial situation and needs, creating tailored financial plans that can include 401ks, IRAs, and more.

This communication contains general investing information that is not suitable for everyone and is subject to change without notice. Past performance is no guarantee of future results and there is no guarantee that any views and opinions expressed will come to pass. The information contained herein should not be construed as personalized investment advice, tax advice, or financial planning advice, and should not be considered a solicitation to buy or sell any security. Investing in the stock market and the bond market involves gains and losses and may not be suitable for all investors. Indices are not available for direct investment.

BIP Wealth, one of the Southeast’s premiere wealth management firms, announced the addition of Chase Murray to its Baseball Division as Business Development Officer. Murray, who played professionally in the Pittsburgh Pirates organization, joins former Pro Ball Players Kyle Schimdt, CFP®, a former pitcher in the Orioles organization; and John Hester, CFP®, a former MLB catcher and professional scout; in the Baseball Division founded by former Major League Baseball relief pitcher Jim Poole.

BIP Wealth’s Baseball Division has extensive experience in wealth management geared towards the unique challenges and needs of ball players and their families. As a former player himself, Murray knows firsthand what his clients may face on and off the field.

Murray was previously a Global Enterprise Business Development Representative with Salesforce. He’s actively involved with his alma mater’s Alumni Association—Georgia Tech.

“We have a unique opportunity here at BIP Wealth’s Baseball Division to make a real impact in our clients’ lives from draft day to life after baseball,” said Murray. “Going through that transition myself to life off the field, I really enjoy being in a position to assist our current players and their familes as they make sound financial decisions for the future. I love being a resource to our clients, helping them in any way I can.”

“Adding Chase to our team has made an immediate impact,” said Kyle Schmidt, Personal Wealth Advisor, CFP® from the BIP Wealth Baseball Division. “As a fellow Yellow Jacket who played professional baseball, Chase, like few others, has walked this unique career path our clients are walking. He understands the opportunities, challenges, and complexities that come from playing the game we all love so much. We’re so excited to grow our team with the addition of Chase.”

Murray is based in Atlanta, GA, out of BIP’s Alpharetta office. Outside of work, he enjoys spending time with his family and friends, including his girlfriend Jenny, and lively boxer puppy Lola. He also enjoys watching sports—especially football—and trying desperately to turn his baseball swing into a decent golf swing. The BIP Wealth Baseball Division serves draft-eligible, current, and retired professional baseball players and their families.

Contact Chase: Chase Murray, BIP Wealth Baseball Division, Business Development Officer

Press Contact: Jenni Brown, Chief Marketing Officer

###

BIP Wealth Family,

As many of you know, our very own, Jim Poole, has been suffering from ALS over the last couple of years after being diagnosed in June 2021. It is with a heavy heart to let you know that Jim passed away last night.

His wife Kim was right next to him, holding him in her arms. She said he’s already organized a baseball game in heaven, so I can only imagine all the great players on both sides.

For those of you who didn’t have the pleasure of meeting or knowing Jim, he was one of the original investors in Buckhead Investment Partners, which became what you know today as BIP Wealth. He believed in the vision Mark Buffington and I shared and has continued to support us in so many ways over the years.

Jim came to work at BIP Wealth as a Portfolio Manager 14+ years ago with the idea to create a Baseball Division to reach current and former players like himself and their families. Over that time, he’s grown our Baseball Division to what it is today. Not only has he impacted the 100+ clients in our Baseball Division, but there’s another 150+ clients that showed up for the tailgate event we hosted last year, “ALS Night honoring Jim Poole” at the Georgia Tech baseball game.

His alma mater, Georgia Tech, wrote a beautiful tribute to Jim today on their website. You can read their post by clicking on the link below.

Kim and the rest of the Poole family appreciate all of the prayers and support over the last 2+ years, but we can’t stop now. Please continue to pray for the Poole family. Pray for peace, and pray for impact, as they continue to raise awareness about ALS.

If you would like to make a donation in Jim’s memory, Kim asked that contributions be made to the James R. “Jim” Poole Athletic Scholarship Endowment Fund. No amount is too small.

If you want to donate to ALS research, ALS Cure Project and ALS.org of GA are the two organizations that Jim and Kim were most closely aligned.

One more thing…several of us got to visit Jim in Hospice yesterday, which was great to see him before his passing. When I walked into the room, he was sporting a bright red, white, and blue PHILLIES shirt. As many of you know, Jim was a die-hard Philadelphia Phillies’ fan, so in Jim’s honor, even though it pains me to say, “Go Phillies!”

[The Braves play the Phillies tonight in the playoffs, so this game will have special meaning thinking about Jim.]

Thank you for being a part of our BIP Wealth family,

—Bill Harris, Co-Founder + CEO, BIP Wealth

We’ve also included below a note written by Mark Buffington, CEO of BIP Capital and Managing Partner of BIP Ventures. Both Mark and I were very close to Jim and will continue to think of ways we can honor Jim moving forward…

This morning, I received the sad news that Jim Poole passed away.

For those who don’t know, Jim was one of the first to invest in Bill Harris and me in 2007 when we started Buckhead Investment Partners (now BIP Wealth). He was one of 10 people who believed in our vision and wrote a check to help us get started.

Jim wasn’t just an investor; he was deeply involved in BIP’s success from the outset.

I will miss Jim. I have missed him over the last year as the effects of ALS limited his ability to interact. But I am somewhat comforted by the fact that he is no longer suffering.

To me, Jim Poole will always be royalty at BIP. He took a chance on us and then nurtured our success. We should all try to emulate the example he set.

Godspeed, Jim.

And to the Poole family, my sincerest condolences.

Mark Buffington

CEO, BIP Capital

Managing Partner, BIP Ventures