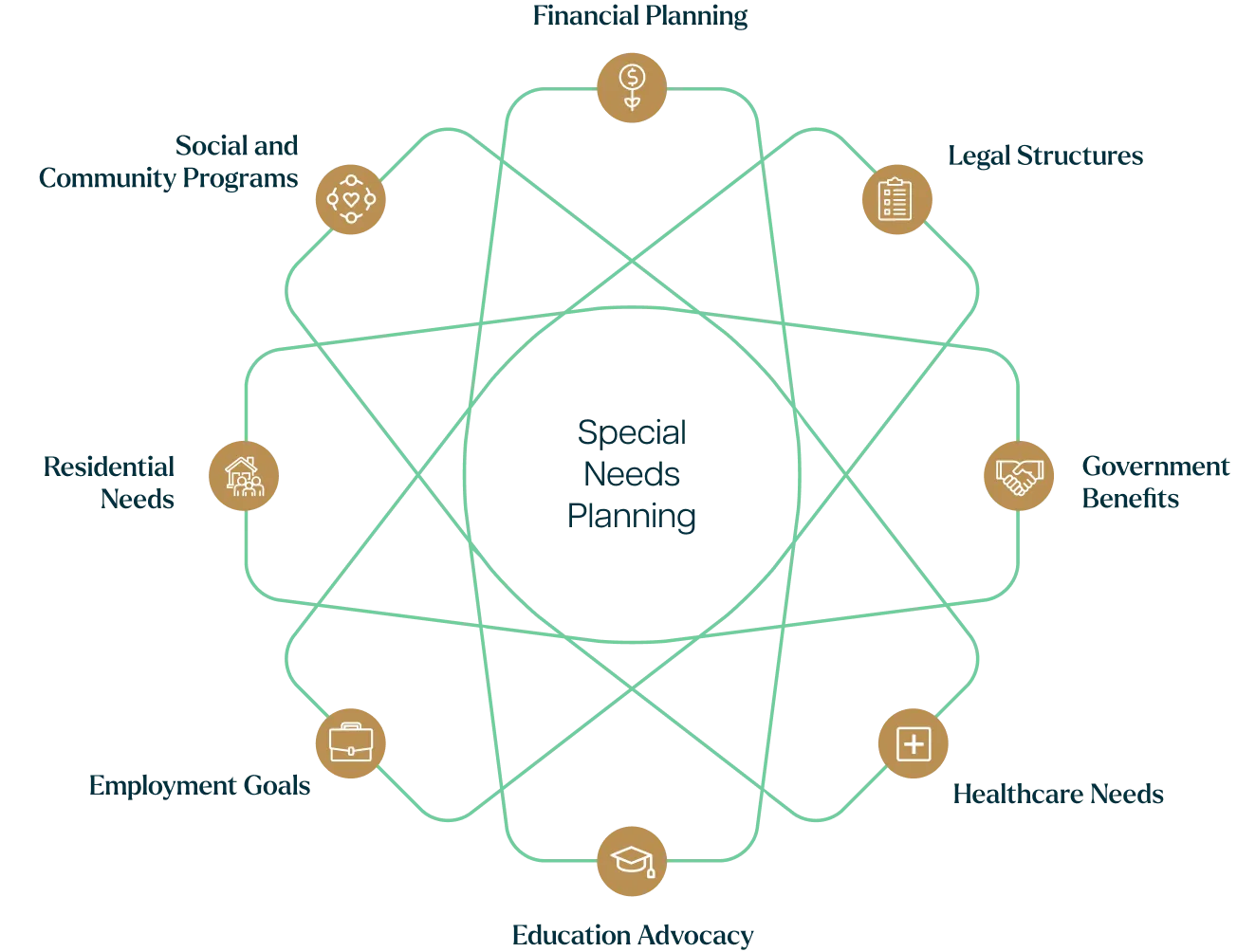

Legal structures like Special Needs Trusts, Wills, Powers of Attorney or even a Guardianship or Conservatorship provide a framework to manage finances and decisions for individuals with special needs, aiming to protect assets, secure benefits, and promote autonomy and dignity.