So, what does 43 days mean for current and retired baseball pros? It is the total number of service days required to qualify for the MLB Pension Plan. The Major League Baseball Player’s Association battled hard to get it in place, so in this blog, we’ll be explaining why it’s important for players to take full advantage.

When the time comes for a player to retire from professional baseball, having access to a share of the MLB Pension Plan can go a long way, especially for those whose careers may have been cut short due to injury. So, what exactly is the MLB Pension Plan? How does it benefit players? And how can a partner like BIP Wealth help baseball players secure their financial future?

The MLB Pension Plan: What is It?

The MLB Pension Plan is a type of employer-sponsored retirement plan, also known as a defined benefit plan. These types of plans provide retired professionals with a monthly payment based on a certain formula.

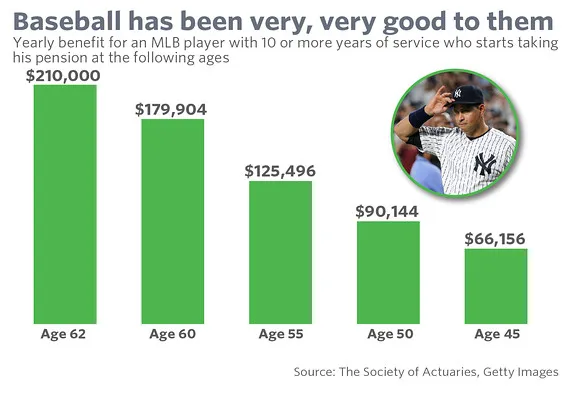

The MLB Pension Plan can be “turned on” as early as age 45, but by waiting until age 62, players would maximize their potential payouts. After hitting 43 days of service, which is defined as days spent on an active MLB roster or injured list, a player qualifies for 2.5% of the max payout. Every additional 43 days will accrue another 2.5% and so on until a player hits 10 years of service, which would qualify them for the max payout.

Currently, the average monthly MLB Pension Plan payout sits at around $7,500 per month, but those who wait until age 62 could top out at around $265,000 per year.

For young and active ballplayers, we recommend focusing on having the most successful and sustainable career possible, as this will directly impact your MLB Pension Plan qualifications. A partner like BIP Wealth will help you navigate the intricacies of your pension plan to better set you up for a successful financial future.

Once you enter your retirement years, our team will work to maximize your accumulated benefits and consider other savings methods, such as IRAs, Roth IRAs, and 401k plans.

The Benefits of an MLB Pension Plan

The upside of having an MLB pension plan goes further than just the obvious benefit of players receiving a guaranteed monthly payment. The money players receive lasts for life, giving them a consistent income to lean into as they enjoy retirement or search for new career opportunities. There is a cost-of-living adjustment with MLB Pension Plans, so payments will increase over time based on inflation.

A retirement plan for MLB players can also give them a sense of financial security for their later years off the playing field. Savings, unlike funds from a pension plan, can easily be spent before retirement, which has led to an unfortunate 78% of former professional athletes going broke within three years of retirement.

On top of all of this, there are also spousal benefits that can be earned through the MLB Pension Plan. This can significantly help beneficiaries achieve the peace of mind that they and their families will be taken care of for life.

What Sets BIP Wealth’s Baseball Division Apart?

At BIP Wealth, we want to make sure every professional baseball player we take on as a client maximizes their financial potential. To do this, we not only help them through their MLB Pension Plan process but also create unique, life-long financial plans that fit the needs of themselves and their families.

As former professional baseball players, our financial advisors have a unique insight into the MLB Pension Plan and how to best plan for what comes after their playing days. This allows us to provide a perspective that most other wealth managers can’t. We’ve been in a player’s shoes, and we can relate to a player’s financial needs and worries.

To learn more about our services and how you can maximize your career earnings, contact us to speak with one of our advisors. You can also schedule a time to talk with us on the phone or at one of our locations in Buckhead, Alpharetta, and Columbus GA, as well as Nashville, TN.

FAQs

How much do MLB players get for pension?

Major League Baseball players receive 2.5% of their max monthly pension plan payout, currently up to $265,000 per year, for every 43 days of active service.

How much is a 10-year MLB pension?

Once a player officially hits 10 years of service, they are eligible for up to $265,000 per year if they wait until age 62 to activate their pension plan.

How much is MLB’s pension per year?

The number varies depending on a player’s number of active service days. At the current max payout, a player would receive $3.18 million per year.

What is your experience and expertise in working with professional athletes, particularly professional baseball players?

At BIP Wealth, our Baseball Division advisors have all been professional baseball players, allowing us to provide clients with a unique perspective that is hard to find anywhere else in the industry.

How can you help professional baseball players optimize their taxes and make the most of their earnings during their playing careers and beyond?

Beyond maximizing their MLB Pension Plans, we take the time to understand a player’s unique financial situation and needs, creating tailored financial plans that can include 401ks, IRAs, and more.

This communication contains general investing information that is not suitable for everyone and is subject to change without notice. Past performance is no guarantee of future results and there is no guarantee that any views and opinions expressed will come to pass. The information contained herein should not be construed as personalized investment advice, tax advice, or financial planning advice, and should not be considered a solicitation to buy or sell any security. Investing in the stock market and the bond market involves gains and losses and may not be suitable for all investors. Indices are not available for direct investment.