Charitable giving is more than a tax deduction strategy for individuals and families. Often, charitable giving reflects personal values, supports causes that matter, and, when planned intentionally, creates valuable tax benefits. This year, that last piece carries more weight than usual. With several Trump tax law changes taking effect on January 1, 2026, donors have a short window to make the most of the charitable giving tax deduction under today’s more favorable rules.

Beginning next year, new limits will reduce how much of your charitable giving can be itemized. For many people who give consistently, 2025 is the ideal time to accelerate or “front-load” gifts before the rules shift. These changes were introduced as part of the recent tax package in the One Big Beautiful Bill, and understanding them can help you make more informed decisions about your philanthropy.

With the current rules in place through the end of this year, donors can still take advantage of today’s full charitable giving tax deduction structure. Contributions to qualified charitable organizations may be deducted from your taxable income, subject to charitable giving tax deduction limits based on both what you give and how you give it.

Under existing IRS rules:

This year’s guidelines remain predictable and relatively generous, which is what makes this year such a valuable planning year for those who want to minimize their tax bill. With several shifts coming soon, it’s worth considering how charitable decisions align with your broader tax planning strategy before the landscape changes.

Starting January 1, 2026, several adjustments will affect charitable giving deductions. While the charitable deduction itself isn’t disappearing, the value of those deductions may decrease unless giving is planned with the new rules in mind.

Here are the key changes happening to charitable giving tax deductions in 2026:

Beginning in 2026, charitable deductions will only apply to amounts above a 0.5% AGI floor. A portion of your giving simply won’t count toward itemized deductions.

Taxpayers in the top bracket will see a reduction of 2% applied to all itemized deductions, effectively amounting to a 5.4% reduction (2% / 37%). This is small on paper but meaningful for larger gifts. The net effect here is that itemized deductions will count as a 35% reduction, instead of 37%.

With fewer itemized deductions available, more people may find they don’t exceed the standard deduction at all, reducing the tax value of charitable contributions starting in 2026.

Because of these shifts, donors who give annually, or who plan multi-year philanthropic commitments, are choosing to “front-load” contributions this year. The goal isn’t to change what you give, but when you give it, allowing you to maximize the charitable giving tax deduction while it’s still fully available.

Here are a few of the most common reasons people are choosing to act now:

“Bunching” multiple years of charitable donations into 2025 helps make sure that total itemized deductions exceed the standard deduction, leading to greater tax savings.

Any gift made in 2025 avoids the upcoming AGI floor entirely, meaning your full donation is deductible (subject to existing charitable giving tax deduction limits).

Since the reduction in itemized deductions doesn’t begin until 2026, gifts made this year retain their full value.

A donor-advised fund (DAF) allows you to take a full deduction this year, then recommend grants to charities gradually in the years ahead. It’s a popular strategy for those who want flexibility without sacrificing tax efficiency.

Your ideal charitable approach depends on your goals, the assets you hold, and how you prefer to support the organizations you care about. These are the strategies many donors evaluate when considering how to maximize the charitable giving tax deduction.

Cash donations remain the simplest and most flexible method of giving. They also allow the highest AGI deduction limit, which is helpful when planning around a single high-impact tax year.

Gifting appreciated stock, real estate, or business interests allows you to deduct the fair market value of the asset and avoid capital gains tax. This approach can also reduce exposure to concentrated positions, which is something often discussed when reviewing overall financial plan risks.

DAFs offer an immediate deduction paired with long-term flexibility. Donors can contribute now and distribute grants at any time in the future. You can gift either cash or appreciated stock. Also, the funds retained in this account are subject to market appreciation, meaning potentially more money that can be given to charity. It’s important to note that these funds must go to a public 501c3 nonprofit organization and are not able to be contributed to any private foundations.

Charitable remainder trusts (CRTs) and charitable lead trusts (CLTs) can support multi-year philanthropic goals, provide income streams, and contribute to estate planning. These strategies often appear alongside broader estate planning considerations.

Regardless of the method you choose, the IRS has clear requirements for claiming the charitable giving tax deduction:

These rules are expected to stay consistent even as other Trump tax law changes take effect.

As you consider whether to act now, you may want to reflect on:

Charitable giving often intersects with broader financial planning, and coordinating those pieces thoughtfully can help you make the most of this unusual year.

With several charitable giving deductions starting in 2026 poised to reduce how much of your donations can be itemized, this year stands out as a meaningful planning opportunity. Whether you’re accelerating your usual annual giving, donating appreciated assets, or funding a DAF, this year offers more favorable conditions for maximizing the charitable giving tax deduction.

To explore which strategies may be right for you, you can connect with a BIP advisor anytime through our contact page.

The answer depends on the type of asset and your AGI. Cash gifts are generally deductible up to 60% of AGI, while appreciated assets typically fall around 30%, subject to IRS rules and charitable giving tax deduction limits.

The charitable giving tax deduction reduces taxable income for donors who itemize. When you give to qualified nonprofits, the value of your gift may be deducted from your income, assuming documentation requirements are met.

Yes—most contributions to qualified 501(c)(3) organizations are tax-deductible, though rules vary based on asset type and annual income limits.

This article is intended for informational purposes only and does not constitute legal, tax, or investment advice. Investors should seek tax advice based on their particular circumstances from an independent tax advisor as tax laws are subject to interpretation, legislative change and unique to every specific taxpayer’s particular set of facts and circumstances.

Signed into law on July 4, 2025, the One Big Beautiful Bill Act, OB3 for short, offers comprehensive tax reform that will take effect on January 1, 2026. To help BIP Wealth clients better understand the new laws, our in-house Estate Planning Attorney, Sarah Watchko, and Tax Advisor, CPA, Allie Powell, teamed up to present a recent webinar. In this recap, we’ll review the key points of their presentation, breaking down what changed and what remained unchanged in our tax laws.

The webinar started with an iconic quote from Benjamin Franklin: “Our new Constitution is now established and has an appearance that promises permanency; but in this world nothing can be said to be certain except death and taxes.” Simply put, while these new tax laws come with changes for now, reforms in the future are to be expected, as tax laws are inherently political. So, what do you need to know about the One Big Beautiful Bill Act? In this blog, we’ll break it down for you.

While we could analyze the entire bill word-for-word, we decided to break our webinar into two main categories: Gift & Estate Taxes and Personal Income Taxes. In each section, we discussed what changed vs. what remained the same, compared to the significant reforms passed in the 2017 Tax Cuts & Jobs Reforms Act.

To start, let’s break down what remained the same. Overall, most of the laws surrounding gift & estate taxes remained the same on the federal level. While specific states may have their own estate taxes, portability, annual exclusions, and the basic framework of the 2017 reforms have all been left untouched.

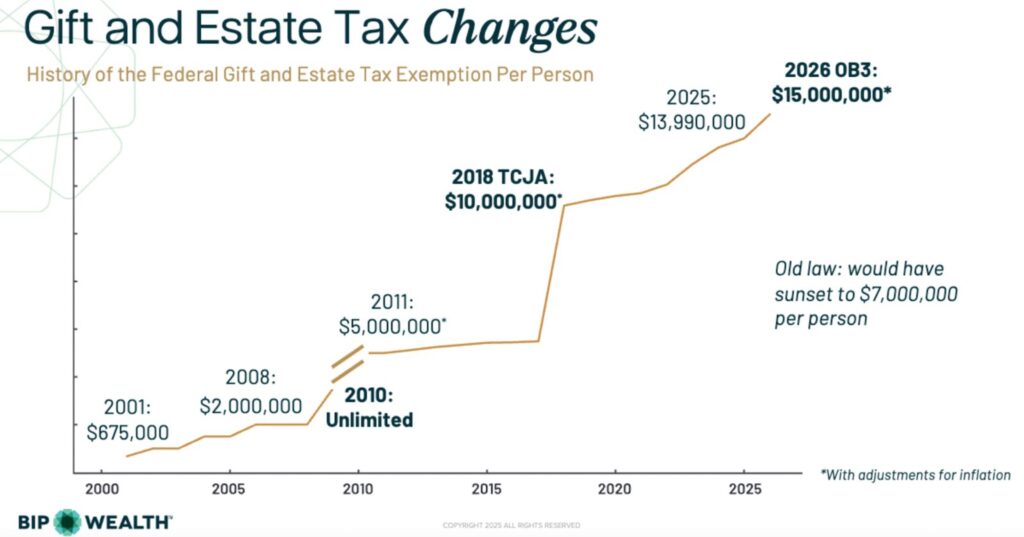

The one big change comes with transfer tax exemptions. Now permanently set at $15 million ($30 million for a married couple), this allows you to transfer assets to a loved one without any taxes being imposed on your estate. For example, if you have $1 billion in assets and gift it all to your spouse during your life, this will not go towards the exemption amount. Plus, with portability remaining unchanged, if the $1 billion is left to your spouse, they can take the $15 million in exemptions with them, thus giving you the $30 million.

Another key tax law that remains unchanged is the annual exclusion. Another way to think about this concept is that the IRS doesn’t want to keep tabs on all of your birthday presents. As of the 2025 fiscal year, any gifts up to $19,000 can go tax-free. And there are no limits on the amount of gifts you can give up to the $15 million exemption.

The chart below tracks how the total exemption amount has increased over time, from just $675,000 per person in 2001.

The impacts of these changes are clear. If your estate is worth under $7 million, or $14 million as a married couple, your estate planning strategies should remain largely unchanged. If your estate is worth between $7 million and $15 million ($14 million and $30 million as a married couple), you are now safer from estate taxes than ever before. If your estate is worth more than $30 million, your strategy would remain largely unchanged. As always, it’s important to regularly consult your tax advisor to ensure your plan continues to adapt to changing financial regulations.

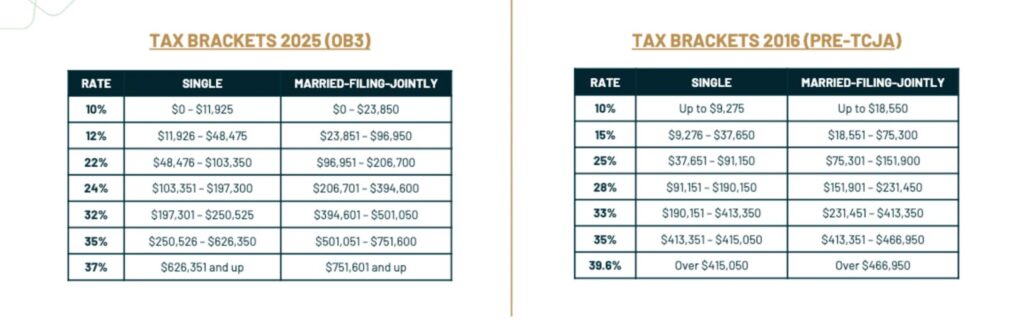

Where the new laws bring a plethora of changes is with personal income tax. Now, this bill was pushed through by Congress. Now, it is up to the IRS to implement each change. OB3 continues a lot of the shifts made in 2017, which at the time was the most significant tax reform since 1986. To set the record straight, Social Security benefits will remain taxable. There were rumors in the media that this was going away, but up to 85% of your future benefits will still be included in your taxable income. That remains unchanged.

The income tax brackets from 2017 also remain the same, giving working families a bit more security in knowing they’ll likely not be paying more in 2026 and the years to come.

Additionally, the standard deduction for taxes remains much higher, with up to $15,000 for individuals and $30,000 for married-joint filings. This can be used for medical expenses, property taxes, charitable contributions, and more.

Now, what will be changing? The short answer is quite a bit. The State and Local Tax Cap (SALT) for individuals has increased from $10,000 to $40,000. While this law phases out higher earners of $500,000 or more, it will allow you to potentially enjoy higher itemized deductions until 2030. On top of this, Trump Accounts will now be opened for kids born from 2025-2028. The federal government will make an initial $1,000 deposit, with up to $5,000 in annual after-tax contributions until the child reaches 18 years of age. Growth is tax-deferred, with early withdrawals after age 18 subject to a 10% penalty. However, many questions remain about how these accounts will work, what will be sunset in the future, and the overall mechanics, so be sure to discuss this with your tax advisor.

Additional changes include a $6,000 deduction for taxpayers 65 years and older, expansions to eligible expenses for 529 funds, and no taxes on overtime and tips up to $25,000. For business owners, the bill also allows for an alignment of tax-deductible expenses with cash flow, plus the potential for significant capital gains savings through company stock.

If you have any questions about the new OB3 laws or need to take a closer look at your current estate plan, contact the BIP Wealth team today!

Disclaimer: This is a very high-level overview of some of the important aspects of the new tax law. It’s intended for general informational purposes, and it’s not intended to constitute tax, legal or investment advice, so if you need or want tax, legal or investment advice, please consult your personal tax professional or estate planning attorney before making any decisions.