Author: Eric Cramer, CFP®, CPA®

Welcome to our recap of the 2024 Q2 Market Report. Eric Cramer, Chief Investment Officer at BIP Wealth, walked our clients through the current state of the U.S. economy and laid out his key takeaways from the second quarter of 2024.

In case you missed the presentation, we’ll break down the major talking points below, including the strong fundamentals we’re seeing and artificial intelligence’s role in combating inflation. You can also watch the recorded version of Cramer’s Q2 QMR by clicking the link below.

Regardless of some of the headlines we’ve seen recently, the U.S. market saw one of its smoothest quarters ever in Q2, according to Cramer. While there were individual stocks that had a rough quarter, a diversified portfolio more than likely enjoyed a smooth, consistent ride upwards. This is highlighted by the U.S. stock market finishing the first quarter up a little over 10%. Now, why is this? For Cramer, it all boils down to the strong fundamentals we’re continuing to see in the U.S. economy.

Unsurprisingly, growth stock led the charge for Q2’s market growth. However, the big news for Cramer is the continued rise in the U.S.’s share of the global stock market. With a current share of $50.7 trillion, the U.S. now controls 63% of the World Market Capitalization. This represents a 4% increase from just one year ago.

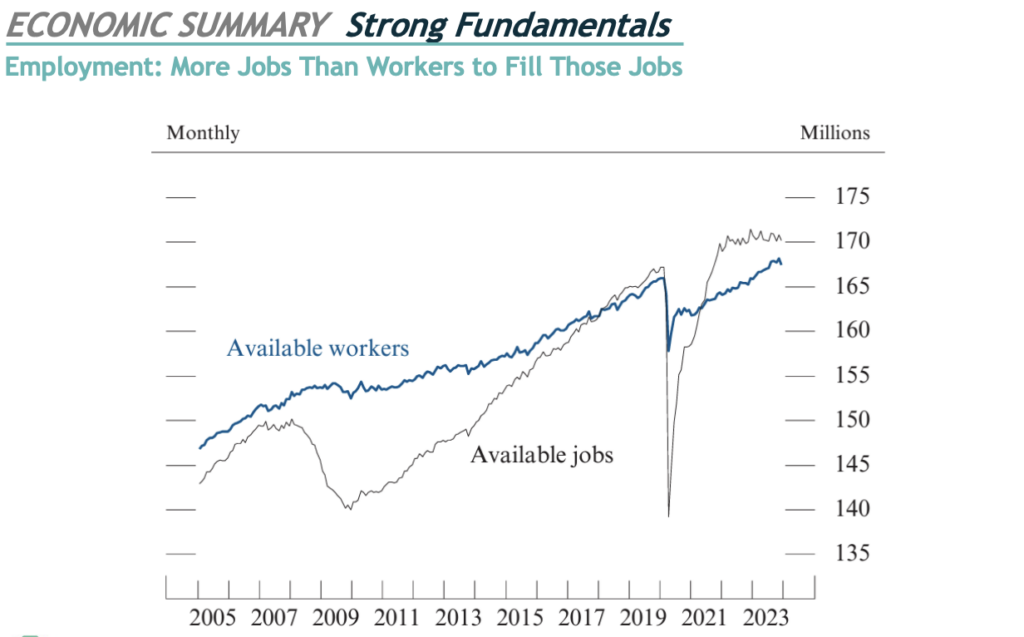

Another strong indicator of our current market health is the rate of available workers to available jobs. In 2020, for example, we saw a dramatic loss of available jobs due to the pandemic. Today, however, the number of available workers is outpacing the number of available jobs, which is great news. For Cramer, it is the backbone of his belief that we are not close to a recession anytime soon.

You may not have heard too much about this one, but we’re seeing unemployment rates among the major demographic groups in the U.S. collectively fall. This is a trend you see during a strong economic surge, regardless of who may be in control in Washington. For Cramer, the differences in the unemployment rates are about as small as he’s ever seen them. So, the rising tides have lifted all boats, if Q2 had anything to say about it.

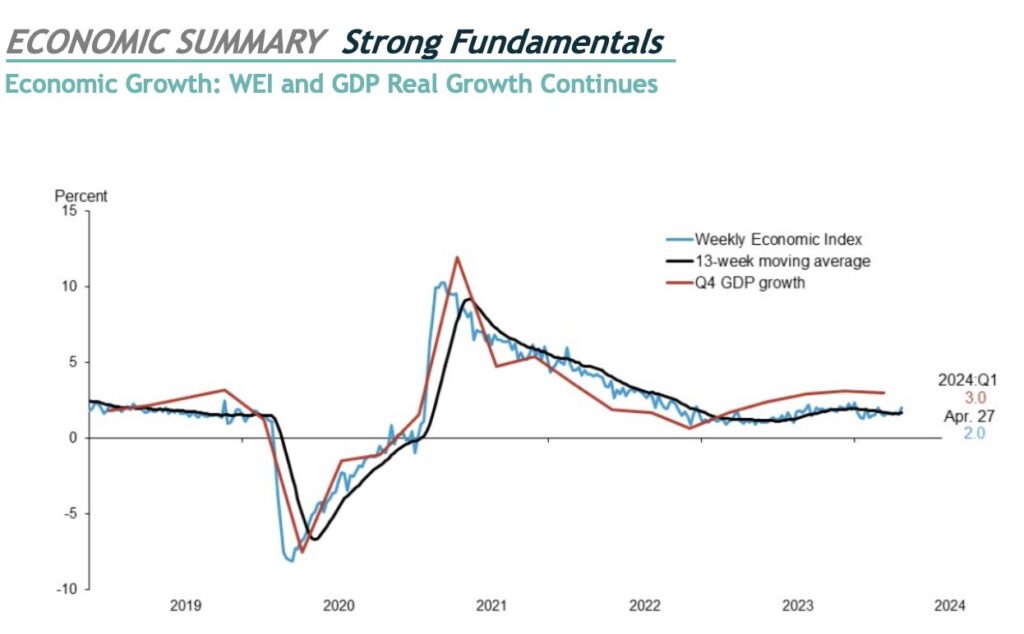

A common piece of data that economists will use to showcase the strength of the economy is GDP. For Cramer, though, the numbers in the Weekly Economic Index are just as important. What we’re seeing is that the WEI rate is settling into a 2% rate of growth. This is considered real growth, over and above the rate of inflation. This rate is very healthy, and it could even see an uptick in the near future.

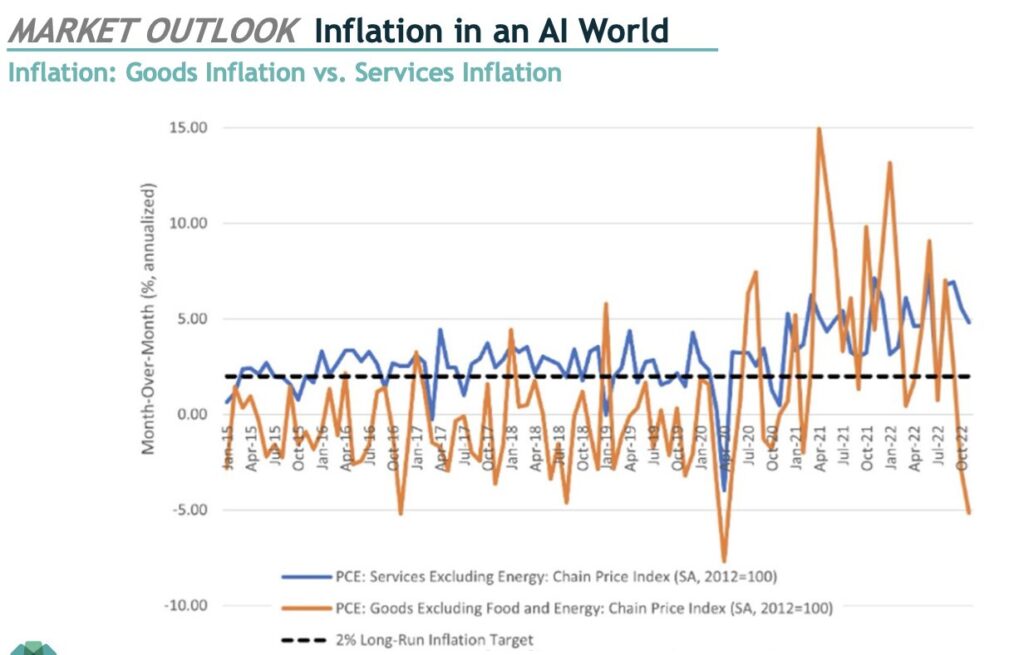

Most of us experience inflation through commodities. You may go to the gas pump and have to pay more than you did the previous visit. You may find yourself seeing higher prices on groceries. Whatever your experience may be, many of us feel the volatility of commodities through these sorts of experiences. This does not paint the entire picture of inflation, however. There is also inflation with services. When we buy things today, we’re very likely to be paying for services as often as we are goods. The chart below demonstrates how as the prices for goods have fallen, the prices for services have gone up.

So, how might artificial intelligence play a role in this world of inflation? For Cramer, there are some similarities and lessons from the past to watch out for. According to a 2023 report from Goldman Sachs, it is estimated that AI could replace 300 million jobs while increasing the GDP by 7% over the next 10 years. As a result, we could see the prices for services decrease as AI’s role in industries such as healthcare, education, and others continues to grow. This is not to say we will need significantly fewer humans in the workforce, but similar to inventions like steam engines and the Internet, AI could help us grow markets through innovation and efficiency, which could lead to deflation.

Before signing off, Cramer left us with four key takeaways from the presentation. These ranged from the rise of AI to the overall themes of 2024:

When examining your financial plan with your BIP Wealth advisor, you may discuss the current political and geopolitical conflicts.

This is easy to miss in an election year. However, our team believes that every broad measure of our economy is healthy as it currently stands.

Don’t shy away from this, though. Instead, embrace what the future of artificial intelligence may hold for financial markets.

From opportunities in public and private markets to BIP’s hedged equity investments, our advisors are hard at work to ensure our clients maintain a diversified portfolio to combat volatility.

If you’d like to speak to an advisor about your portfolio or want to learn more about how we’re engineered to perform for our clients, be sure to contact us. You can also check out the rest of our resources hub to learn more about the financial market.

This communication contains general investing information that is not suitable for everyone and is subject to change without notice. Past performance is no guarantee of future results and there is no guarantee that any views and opinions expressed will come to pass. The information contained herein should not be construed as personalized investment advice, tax advice, or financial planning advice, and should not be considered a solicitation to buy or sell any security. Investing in the stock market and the bond market involves gains and losses and may not be suitable for all investors. Indices are not available for direct investment.

Author: Eric Cramer, CFP®, CFA®

If you’ve ever gone through the financial and investment planning process, you might remember that it took some effort. But you might look back at that investment in time and feel some sense of satisfaction that you did something for yourself and your family. Unfortunately, investment planning may be extremely dangerous to your financial health. Here are the top five reasons why:

How many working people can look back a decade and say that they would have accurately predicted their current income level? Fortunes change, people lose their jobs, people get promoted, and the future is unknown for most of us. Because of this, future earnings become one of the biggest financial planning mistakes people may make. If your financial plan assumes you have a healthy income for decades into the future, but that doesn’t happen, do you expect your retirement lifestyle to be the same? Anyone more than ten years from their planned retirement needs to understand why a certain income figure was used in their plan, and they might want to make their income estimates extremely conservative just to test for problems with their plan. A good advisor may even run more than one plan, using different income levels, to examine the sensitivity of the plan to this input. Another technique used for people approaching retirement is to assume that all income ends in the current year. This helps establish what your “worst-case scenario” may look like and every year of additional income just makes things better.

Life expectancy is a tricky thing for anyone to predict. The best investment planning probably assumes a very long life expectancy, because outliving your money is the biggest risk most people face. Avoiding “superannuation” is the main motivation for many people to engage in investment planning, which is why some planners may suggest using a life expectancy that you only have a 10% chance of achieving. This doesn’t mean that this estimate is more accurate, it simply provides a more prudent way to think about how to plan.

If your investment planning doesn’t address the concept of investment expenses, then you may need to ask some questions. Another big financial planning mistake you can make is not taking into consideration what you’re paying in fees and even taxes on investments. For example, your stock broker may start to crank out financial plans that use index returns to predict portfolio returns. But the reality may be that your investment accounts become full of high-cost mutual funds, annuities, and other fee-laden investment products that may not be able to quickly adjust to market shifts. It isn’t unheard of for an investor to pay more than 2% in total investment expenses (and sometimes much higher) while relying on a financial plan that assumes there are zero investment expenses. For a $1 million portfolio, that’s $20K per year that doesn’t compound. If you don’t think investment expenses are a big deal then consider this: at the end of 2017, the average annual return of the MSCI ACWI IMI Global Equity Index for the prior ten years was only 4.97. And the Bloomberg-Barclays U.S. Aggregate Fixed Income Index return over that decade was only 4.01%. If your portfolio was paying an extra 2% in fees then, depending on your allocation, you may have barely kept half of your returns. At the end of the day, your investment expenses really do matter.

Taxes are boring, yes, so let us tease you with this idea: if you own an actively traded mutual fund, and it realizes short-term capital gains (from selling stock it owned less than a year), then the fund has to distribute those gains to you along with a tax on the investments. Your investment planning advisor may not see it coming, and there may be little you can do to stop it. To make matters worse, the distribution that hits your account will now be taxed at your highest marginal rate (because it’s a short-term gain). On top of this, distributed short-term capital gains cannot be offset with realized capital losses. So, if your super stock-picking mutual fund was up 20% in a big year, but sold most of its holdings to reposition, maybe you had 10% distributed to you at a tax cost of around 4-5%. Suddenly that terrific 20% turns into only 15%. The big pothole here is when a fund has a down year, but still sells some winners, and you pay investment taxes on a negative return! It’s happened before and it will surely happen again. Will you make this common financial planning mistake?

Some investors won’t need Social Security to have a terrific retirement, but for most of us, it will at least play an important role. And here’s the thing: Social Security has its risks. It’s not hard to be cynical about this program run by the Federal Government, but in the interest of giving respect where it’s due, the Trustees responsible for running this giant entitlement program write some of the best financial reports you will ever read. They have been telling us for years that there are major Social Security risks ahead, and it’s getting closer to reality. In the 2023 Annual Report, it was estimated that in all likelihood the program will exhaust itself by 2033. At that point, they estimate, benefits will have to be cut by 23% to match annual tax collections. We can’t know how our current and future politicians will address this problem, but if your investment planning isn’t assuming a cut to your currently legislated benefits, you may be counting on money that you will never receive.

At BIP Wealth, we focus on holistic wealth management to help our clients fortify long-term success and avoid the common financial planning mistakes you read about above. To learn more about our services, check out our What We Do page. If you’d like to get in touch with one of our wealth advisors, feel free to contact us!

How do I estimate future earnings?

Although it is very difficult to accurately predict your future earnings, it may be helpful to create more than one investment plan to determine what your financial situation could look like in different scenarios.

What is superannuation?

Superannuation refers to a retirement savings system in which individuals set aside a portion of their income during their working years to fund their retirement. It is commonly known as a pension or retirement fund.

What is an investment expense?

Investment expenses refer to the costs associated with managing and maintaining an investment portfolio. These could include advisor fees, taxes, and operating expenses.

When do you pay taxes on stocks?

Taxes on investments like stocks are typically realized when you sell them for a net gain or loss.

Is Social Security at risk?

In a recent estimation, it was said that Social Security could exhaust itself by 2033, resulting in a 23% benefits cut.

This communication contains general investing information that is not suitable for everyone and is subject to change without notice. Past performance is no guarantee of future results and there is no guarantee that any views and opinions expressed will come to pass. The information contained herein should not be construed as personalized investment advice, tax advice, or financial planning advice, and should not be considered a solicitation to buy or sell any security. Investing in the stock market and the bond market involves gains and losses and may not be suitable for all investors. Indices are not available for direct investment.